A parent’s guide to choosing a guardian for your child

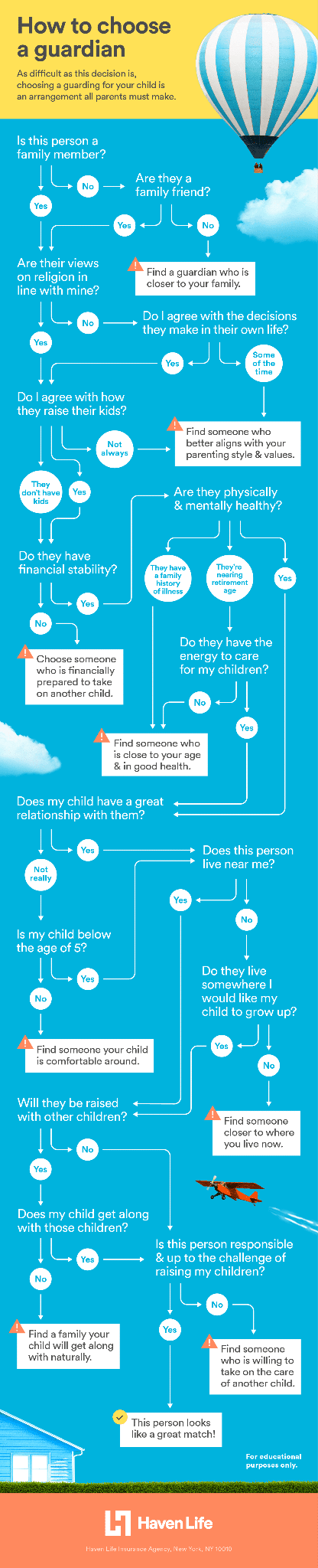

Consider these tips from legal experts when selecting your child’s guardian and use this flowchart to bring up questions to ask when making your decision.

No one wants to think about the possibility of someone else raising their child, but it’s important to have a plan for your children if something were to happen to you and your partner. As difficult as this decision is, choosing a guardian for your child is an arrangement all parents must make.

There are two types of guardians you can select — guardian of the estate and guardian of the person. A guardian of the estate is responsible for managing your child’s finances if you pass away. A guardian of the person will be the legal guardian of your child when you’re gone.

If you don’t name a guardian for your children, the court will. So, it’s in your child’s best interest to handpick a guardian who matches your values and will provide a life for your little one you can feel confident about.

Before you go naming your sister-in-law or your elderly parents, you should think about a few things to make the process easier. Below are tips to consider when choosing your child’s guardian, along with quotes from real parents and a flowchart that covers questions to ask in the decision process.

In this article:

1. Make a list of potential candidates

Envision the life you want for your child and begin listing out possible candidates. Start with immediate family members such as siblings and parents and work your way out. John E. O’Grady, an estate-planning lawyer in San Francisco, told Parents that “many parents feel duty-bound to choose a close family member, but you need to expand your scope for your child’s sake.”

Sit down with your partner and write down a list of around ten potential candidates. Make sure to include family members, distant relatives and close friends. Mickey Mikeworth at Mikeworth Consulting, a private consulting service, says that she has a combined family and had to have two separate guardian plans for each of her kids because they had different parents.

“For my husband’s children, we chose someone who could actually move into our home if needed. For my child, we chose a family member that he was very close to and would adopt him as their own.”

2. Consider your values compared to theirs

Consider your moral, political and religious beliefs compared to the people on your list. Carole Summers, a family psychotherapist, told Today’s Parent that you should consider your own parenting style.

“Are you authoritarian, overly permissive or a firm-yet-flexible parent? You want someone who has a similar approach and who shares your values” she explains. This stability in parenting will make it easier for your child to carry on after you’re gone.

Denna Babul, an author, TV personality and speaker, says when choosing a guardian for her and her husband’s children, it came down to their core values. “We had family we dearly love, but realized they may or may not raise our kids with the values we hold dear to our hearts. I would say that parents need to look at the adults around them and see who they truly believe will hold their values.”

“Do they treat others kindly? Are they charitable? Do they have integrity? Are they trustworthy?” Babul adds.

3. What is their family life like?

When you choose someone to be the guardian of your children, you’re selecting their whole family, not just them. Make sure their family life is similar to yours. For a lot of parents that means finding a family where the couple has a stable relationship. For others, having children for their son or daughter to bond with may be most important.

Joe Flanagan, community lead at DaddiLife, says that it came down to the existing relationship between the future guardian and his or her partner. “Of course, it’s important you trust the person(s), but the main thing for us was choosing a couple who were in a stable and likely ‘forever’ relationship,” he explains.

4. Are they financially stable?

While you may feel tempted to choose your sibling or family friend, make sure you choose a legal guardian who is financially stable enough to take on the care of another child. Do they own a home? Have a stable job? Have any significant debt?

Jess Holmes, a mother of three boys, says that she and her husband prioritized their options “by deciding who was financially in a position to take on three more children and love them unconditionally, of course. For us, it was my father-in-law.”

Your potential guardian will most likely be listed as the contingent beneficiary in your life insurance policy. This is the person who will collect the death benefits if your primary beneficiary is unable to collect them. Be sure the person you choose is financially responsible enough to handle any finances for your children.

5. Where do they live?

Consider that your children will likely move into the home of the guardian you choose. Stability is vital to children, and you may not want to move your kid to a different state if you don’t have to. “A cross-country move won’t matter to a baby or a toddler, but you’d rather not uproot school-age children from their friends and familiar surroundings,” explains Liza Hanks, author of The Mom’s Guide to Wills and Estate Planning.

Think about where the potential guardian lives and if you can picture your child growing up there. If you live in a suburb, try to find a guardian who lives in a similar neighborhood to yours. Moving your child to a city could be a big culture shock, so aim to keep their living situation as close to yours as possible.

6. Take age and health into account

Your parents may seem like the best option right now, but will they be able to run after your toddler? Will they be able to take your teen to and from soccer practice? “The issue that I frequently encounter as an attorney when selecting a guardian is the potential for ‘changed circumstances,’” says David Reischer, a family lawyer and CEO at LegalAdvice.com. “I have had to change an already court-approved legal guardianship of a minor after health issues developed in the guardian.”

Checking the age and health history of each potential guardian is an important step. Make sure to select someone who will be there until your child turns 18 — and potentially beyond.

7. Select your guardian(s)

Once you have taken all of the above into account, it’s time to select your guardian. Consider choosing two guardians if it makes sense for your situation — a guardian of the estate (someone to handle the finances) and guardian of the person (someone to handle your child’s daily life). Find someone who you and your partner both agree on and who has the finances, family life and values you feel comfortable with. Consider picking a back up guardian in case they end up saying no.

8. Ask permission

Asking your chosen guardian for permission is a memorable moment. “Make the ask special by writing a personal letter or sharing your heart with the couple in person,” says Denna Babul. “Allow them time to consider the ask and make it communicative.”

Start the conversation by first thanking them for always being there for you and your family. Then, preface the question by saying that you would like them to really think and consider your question since it could change their lives forever. After asking, have an open and honest conversation about your expectations and the responsibilities that come with being a guardian.

How to choose your guardian

This is the hardest part for a lot of parents because it makes this important decision so final. When parents die without naming a guardian ultimately leave the fate of their kids in the hands of a judge. Choosing a guardian for your children is something you must face as a parent. However, if you’re comfortable with your choice, all you have to do is name the person in your will.

Get together with your spouse and create a last will and testament if you haven’t already. Make sure you have the correct information for the guardian you choose and write down any specific wishes you have. Any verbal agreements you make with the guardian will not hold up in court.

No one can replace you as a parent and the thought of someone else raising your children is scary. However, if you find someone who mirrors your values, has stable finances and a family your child feels comfortable around, your child will be in the right hands if something were to happen to you and your partner. For more tips on how to choose a guardian for your minor children, check out our flowchart below that covers questions you should be asking yourself.

About Tom Anderson

Tom Anderson is an award-winning financial journalist whose work has appeared in CNBC.com, Kiplinger’s Personal Finance, Money, Monocle and Wired. He was a 2008-09 Knight-Bagehot Fellow in Economics and Business Journalism at Columbia University.

Read more by Tom AndersonOur editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus