Making financial decisions is hard. This bracket makes it easier.

We asked four experts to rank popular money goals on a basketball-style bracket. Will your picks match theirs?

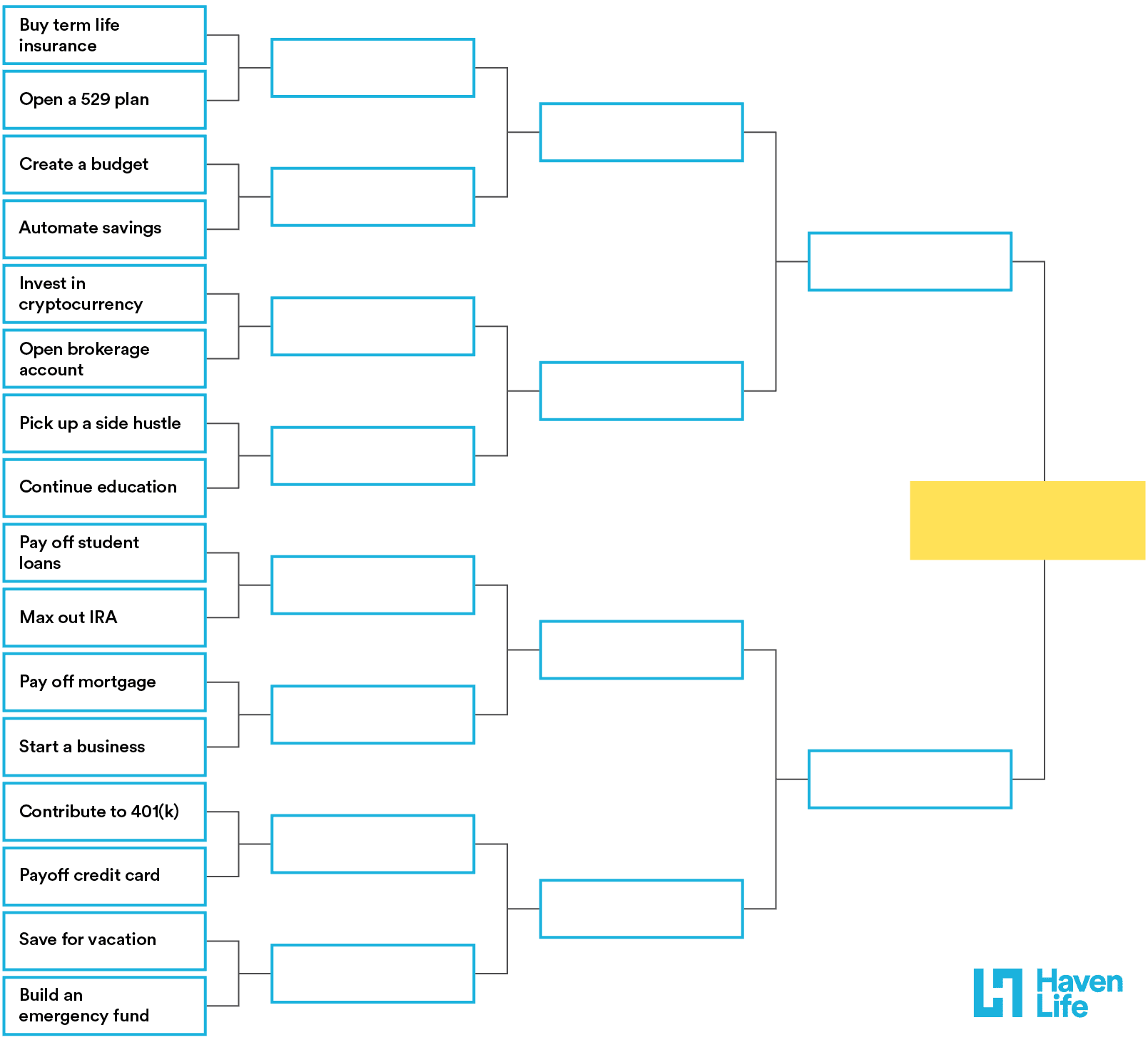

A certain beloved basketball tournament might have been canceled this year, but we’ve created a different bracket for you to fill out. We’re calling it the Best Money Moves Bracket, and it’s designed to make financial decisions easier. For example, what should you do with remaining funds from a bonus or paycheck —put it toward paying off your debt? Stash it in an IRA? Put it towards your vacation fund?

A lot of us have several money-related goals, and it can be hard to prioritize those goals in the near- and long-term for our financial well-being. As the saying goes, time is money—and if we don’t make smart financial decisions in the here and now, we risk either missing out on additional earnings (through, say, earned interest or the increased market value of our investments) or compounding our debts (by missing a payment, or just accruing additional interest).

That’s where the Best Money Moves Bracket comes in. We took 16 of the most popular financial goals, matched them up head-to-head and asked four financial experts — Mary Beth Storjohann, Shannah Compton Game, Joe Saul-Sehy and Sam Dogen — to select a winner from each matchup until they chose an overall champion.

Before we get to our experts’ brackets, here’s an opportunity for you to review the sweet 16 of financial goals and ask yourself how you’d rank them. If you were filling out your own Best Money Moves Bracket, what personal goal do you think should come out on top?

Now that you’ve had the chance to think about which financial goals might win the tournament, let’s see if your picks match our experts’. (We’re sorry to report, however, that you’re on your own for running the office pool.)

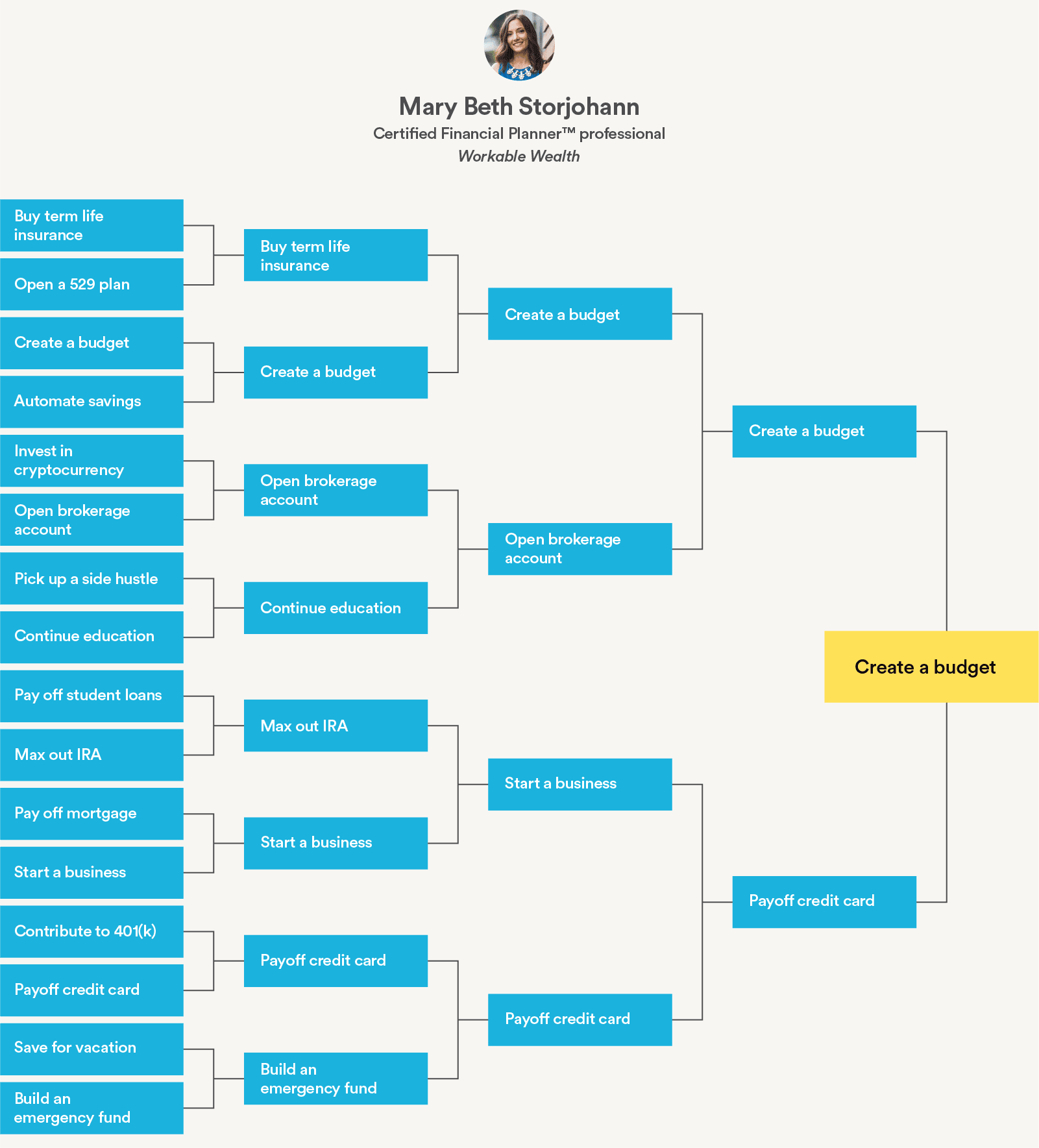

Mary Beth Storjohann: Create a budget

Mary Beth Storjohann, CERTIFIED FINANCIAL PLANNER® professional and founder of Workable Wealth, knew her bracket would come down to two goals. “I realized it was always going to be a budget or credit card debt paydown that came first,” Storjohann explains. “As a financial planner, that’s where we start before all of the other items come into play.”

Ultimately, Storjohann picked create a budget — which you can then use to help you pay down your debt.

If you need a little help creating your personal budget, we’ve got a guide to help you build a budget that works and a list of the top budgeting apps of 2020. Once you have a budget in place, it’ll be a lot easier for you to work toward any of the other fifteen goals on the Best Money Moves Bracket — whether you decide to pay down debt, save an emergency fund or plan a dream vacation.

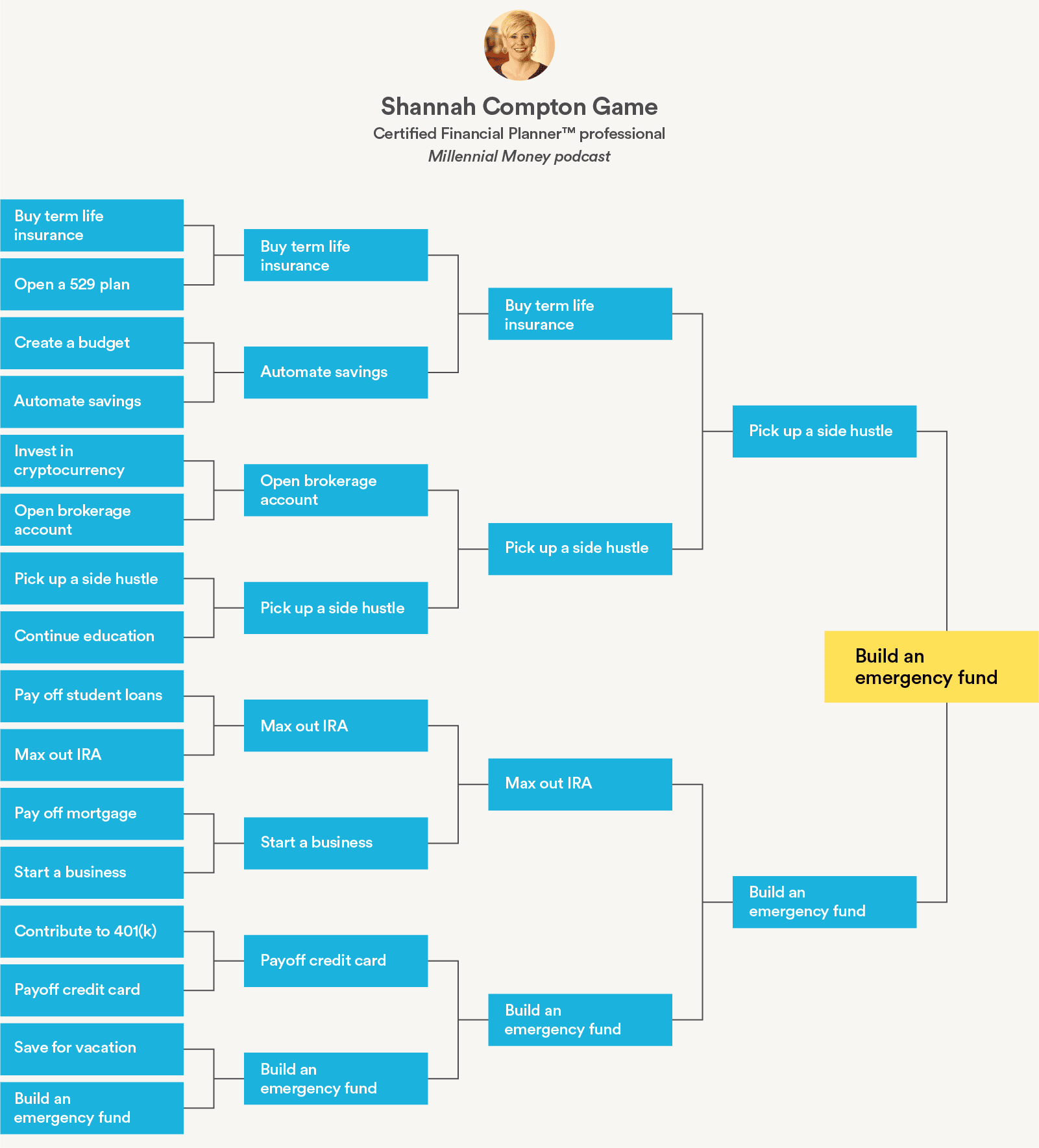

Shannah Game: Build an emergency fund

“I selected build an emergency fund as my top goal because I believe that having some cash on hand is imperative,” Shannah Compton Game, CERTIFIED FINANCIAL PLANNER® professional and host of the Millennial Money podcast, says. “Having a six-month pad gives you options and choices that you might not have otherwise — prepared for an unexpected health bill, losing your job, getting married, having a baby, car accident, home repairs, etc.”

That said, Game believes that all of the goals on the bracket are important and should be addressed at some point in time — though you’ll need to decide which goals are most appropriate for you right now, given your income, your expenses, your time commitments and your hopes for the future. “Don’t feel like you have to tackle them all at once,” Game advises. “Pick one thing you can do today to better your finances and focus on that.”

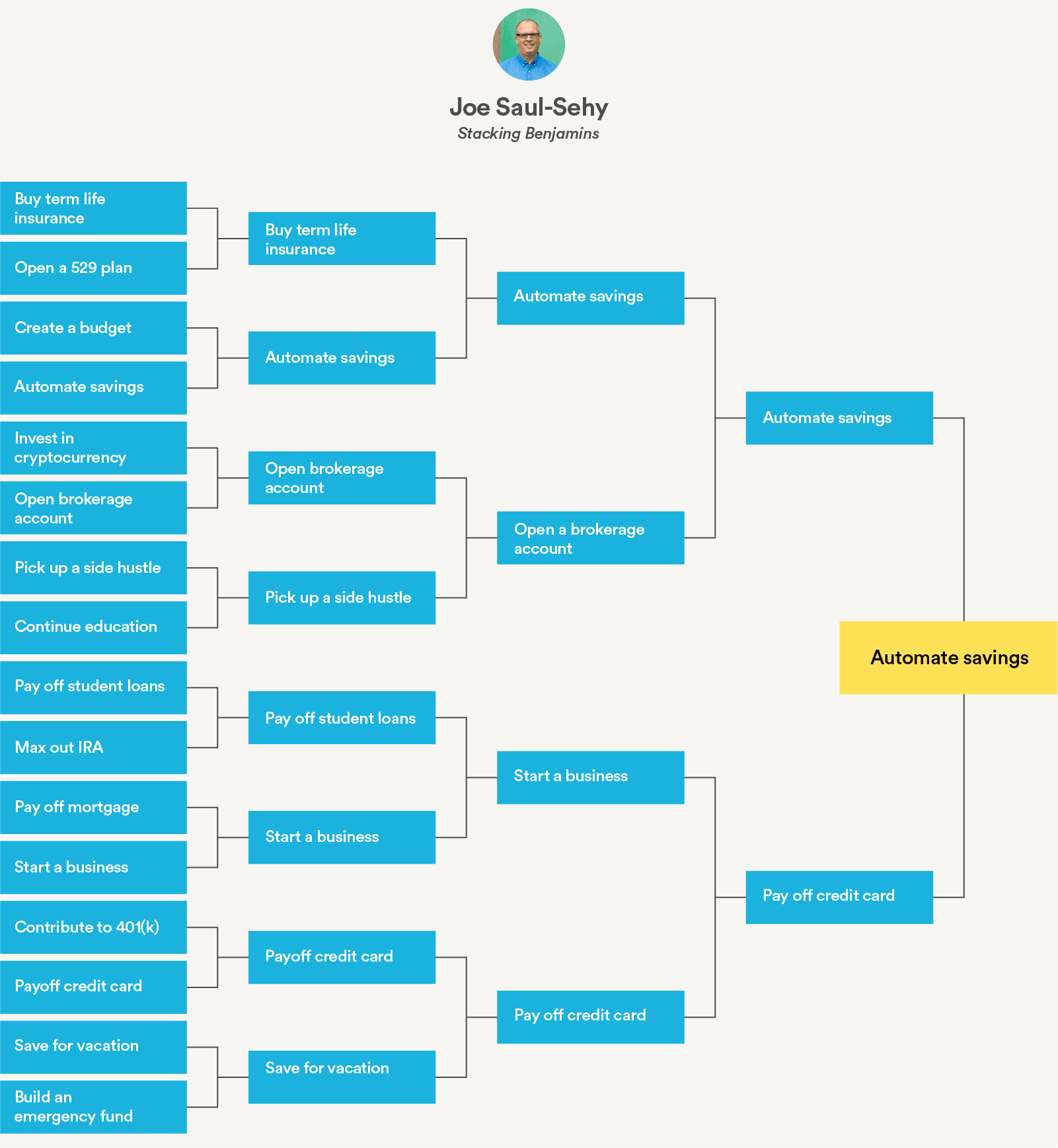

Joe Saul-Sehy: Automate your savings

Joe Saul-Sehy, former financial advisor and creator of the Stacking Benjamins podcast, doesn’t like to see people trip themselves up on when they should be spending and when they should be saving. So he picked automate your savings as his bracket winner — because once you start automatically transferring money to savings on a regular basis, you won’t have to continually make decisions about when (or how much) to save. “You reinvent the wheel with saving every time, if you don’t automate,” says Saul-Sehy.

As you continue to grow your income or reduce your expenses, send at least some of that money directly to savings — and automate it, so that money never has a chance to go anywhere else. “If you cut cable, autosave the $20,” Saul-Sehy explains. “You’ll automatically become more wealthy and will never have to think of it again.”

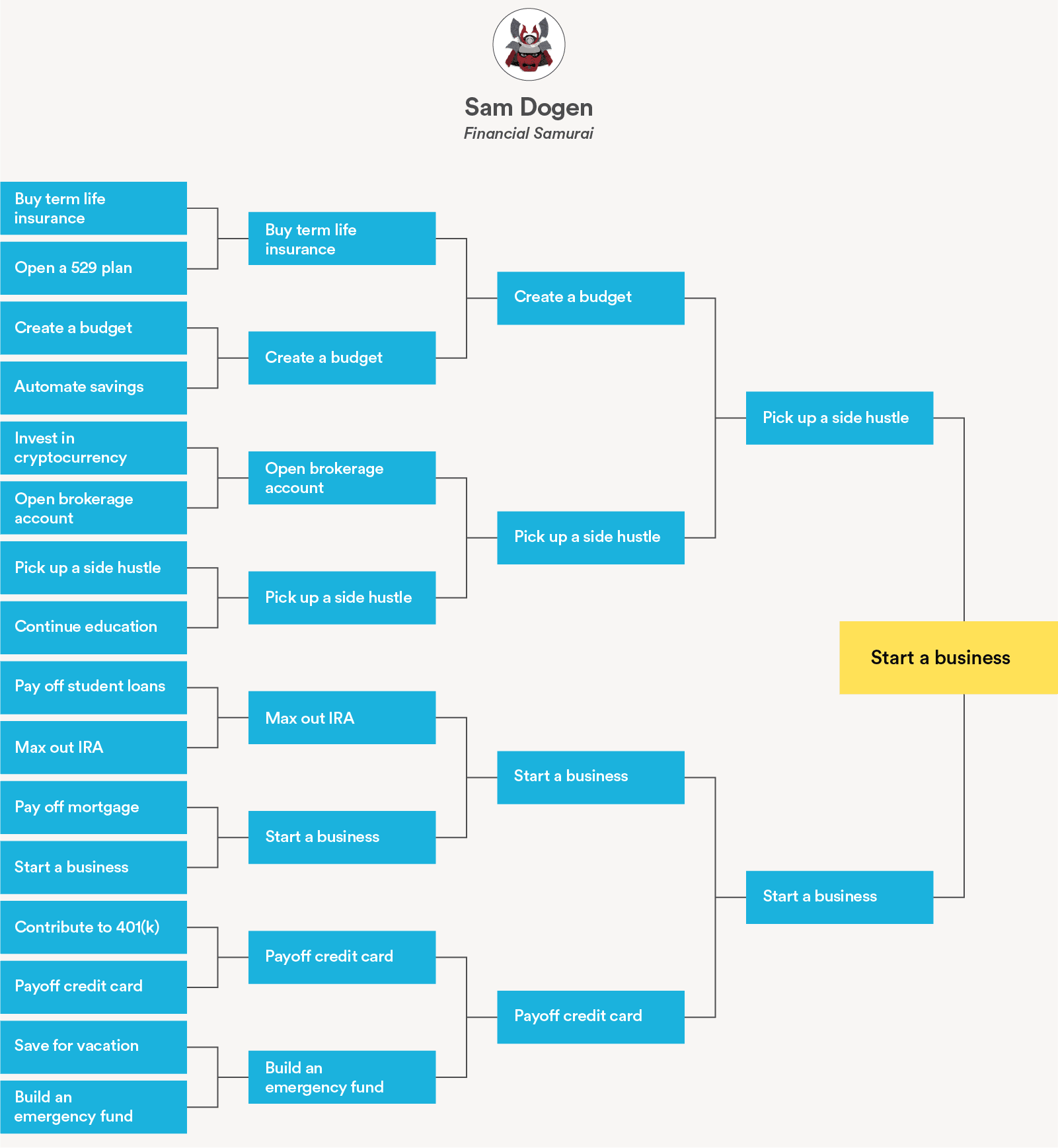

The Financial Samurai: Start a business

“Saving money is a default assumption,” Sam Dogen, aka the Financial Samurai, told me. “But it’s hard to save your way to outstanding wealth.”

This is why Dogen chose start a business as his top bracket pick.

This isn’t to say that the Financial Samurai thinks you shouldn’t save money. In fact, he believes everybody should max out their IRAs and 401(k)s whenever possible. He also advises people to pay down their high-interest credit card debt as quickly as possible. But when it comes down to choosing a top financial goal, well — I’ll let Dogen have the last word: “It’s not enough to just depend on a day job to make money and grow wealth anymore. Starting a side hustle or a side business is absolutely a must if you want to achieve financial freedom sooner rather than later.”

If you filled out your own Best Money Moves Bracket bracket, share it with us on Twitter (@havenlifeinsure) or on Instagram (@havenlifeinsurance), tagging us and using the hashtag #BestMoneyBracket. Let us know why you picked the goals you did — and what you’re doing to achieve your financial goals.

About Nicole Dieker

Nicole Dieker has been a full-time freelance writer since 2012, with a focus on personal finance and habit formation. In addition to Haven Life, her work regularly appears at Lifehacker, Bankrate, CreditCards.com, and Vox. Dieker spent five years as a writer and editor for The Billfold, a personal finance blog where people had honest conversations about money, and is the author of Frugal and the Beast: And Other Financial Fairy Tales.

Read more by Nicole DiekerOur editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus