What are the different life insurance risk classifications?

Curious about the different risk classifications involved in life insurance? Read on to find out more.

An affordable term life insurance policy is one of the best ways to help financially protect your loved ones — but even though most term life policies are designed to fit into the average household budget, not everyone pays the same amount of money for their life insurance policy.

There are many factors that go into your life insurance premium costs, including the amount of coverage you take out and the term length you sign up for. However, many people don’t realize that life insurance risk classifications also play a significant role in their monthly premiums. They also don’t realize that they can improve the possibility of falling into a better underwriting risk classification by applying for life insurance when they are either relatively young or relatively healthy — or, in a best-case scenario, both.

When you fill out a life insurance policy application online with an insurance provider, you are categorized into one of multiple risk factor classifications used by underwriters to help determine your policy rates. What are these classifications of risk in insurance, and how can you improve your life insurance risk classification? Here’s what you need to know about underwriting risk classifications — and what you can do to receive the best classification possible for your life insurance plan.

In this article:

What is classification of risk in insurance?

All insurance involves some kind of risk assessment, whether you’re taking out a life insurance policy, applying for car insurance or getting a family heirloom insured. Risk classification and management in insurance helps keep everybody’s policy rates as affordable as possible — but these risk classifications that are established during the underwriting process also mean that some people pay more for insurance than others.

“When someone applies for life insurance and they get approved, their premium is based on their underwriting risk classification,” explains Kristen Wilson, Underwriter Innovation SME at Haven Life. If you apply for a Haven Term life insurance policy, for example, you could fall into one of five underwriting risk classifications — and these classifications affect how much you pay in monthly life insurance premium costs.

“Haven Life’s risk classes are divided into two categories,” says Wilson. “Preferred, which is also known as standard, and substandard.”

If you are in a standard or preferred class, it means that you are in a low risk category and are likely to pay lower premiums. If you are in a substandard class, it means that you are in a higher risk category — and therefore you may have to pay a higher premium.

What factors determine underwriting risk classifications?

The life insurance risk classification used by underwriters is based on an applicant’s total health profile — as well as how that health profile compares to other people of the same age and gender. “We check prescription history,” Wilson explains. “We look at your history of nicotine use, even if you quit.” Essentially, a life insurance company is trying to determine your overall health, as well as your potential health risks — and how those risks might affect your overall lifespan.

If you apply for medically underwritten life insurance, expect to provide a family health history as part of your life insurance application — and be prepared to complete a brief life insurance medical exam. These in-person assessments, combined with sophisticated risk classification algorithms, will help determine your classification of risk in insurance. During the underwriting process, the life insurance company may look at your personal medical history, your family history, and may check to see if you are at high risk for a specific health condition like heart disease.

Your risk classification will also determine how much you pay for your life insurance policy. In general, better health correlates with lower life insurance premiums — but you can still receive a preferred or standard life insurance risk classification even if your health isn’t perfect. “You might have better than average blood pressure and BMI,” Wilson offered as an example, “but maybe you have high cholesterol.” As long as your health is better than average, you’re likely to pay lower than average premium costs.

What is the best risk classification used by underwriters?

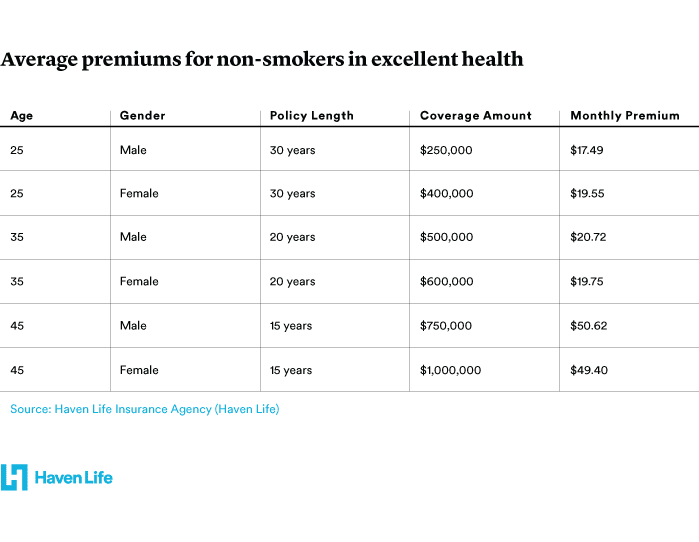

Haven Life’s best life insurance risk classification is Ultra Preferred Non-Tobacco. To receive this underwriting risk classification, you need to be in excellent health with no history of tobacco use within the past year. Believe it or not, the majority of Haven Term policyholders fall into the Ultra Preferred Non-Tobacco classification — in fact, as of March 2021, 60 percent of all policyholders received this top-level risk classification. These policyholders pay the lowest possible premiums for their term life insurance policies. This chart illustrates the premiums that those in the best life insurance risk classification for Haven Term might expect to pay per month.

If you don’t think you’ll qualify for Haven Life’s best risk classification group, don’t let that deter you from applying for a Haven Life term life insurance policy. You might pay more for your monthly life insurance premium, but Haven Life policies are designed to fit nearly every budget. You can even request a free quote to see just how affordable your policy might be.

How can you improve your life insurance risk classification?

If you’re planning on applying for life insurance in the near future — maybe you’re thinking about getting married, for example, or maybe you’re hoping to start a family in the next few years — it is possible to improve your life insurance risk classification before you apply for life insurance.

Most term life insurance policies offer guaranteed level premiums that remain constant for the length of your policy, which means that it is to your advantage to apply while you are relatively young and in good health. The premium you pay today will be the same premium you’re paying 10, 20, or even 30 years from now, depending on which life insurance term length you choose — so why not try to get the best life insurance risk classification possible and keep that premium as low as possible?

If you want to improve your life insurance risk classification before taking out a term life insurance policy, start by taking a few basic steps to improve your health. If you smoke, for example, you’ll probably want to quit — especially because going nicotine-free for two or more years could significantly reduce your life insurance premiums. If you have high blood pressure or high cholesterol, talk to your doctor about how to bring those numbers down. Even something as simple as healthy eating habits combined with regular exercise could have a positive effect on your life insurance risk classification — and don’t forget about getting good sleep. (Tell yourself that those extra ZZZs will save you $$$.)

What if you don’t want to take a life insurance medical exam?

Medically underwritten life insurance policies, in general, offer lower monthly premiums than no-medical-exam life insurance — but if you’re looking for something a little simpler than a standard medically-underwritten policy, you might want to consider Haven Simple.

Haven Simple offers a medically underwritten term life insurance policy that…does not require a medical exam. It’s a good choice for people who are already in good health and want a quick and easy way to apply for term life insurance. New parents, for example, might find the Haven Simple application a perfect fit for their busy schedule — the application can be completed in minutes, you’ll receive immediate notification about your approval status and (if approved) coverage begins as soon as you make your first premium payment. Keep in mind that Haven Simple tends to be more expensive than Haven Term since underwriters will know less about your health.

Just because you choose a no-exam policy like Haven Simple doesn’t mean that you get to avoid life insurance risk classifications. You’ll still need to answer a few basic health questions as you complete your Haven Simple application, and the answers to those questions could affect your monthly premium rate. (You also need to be truthful in your responses, or it could adversely affect your beneficiaries down the line, as issuance of the policy and payment of its benefits depend on your answers.) Haven Simple gives you the opportunity to quickly set up your life insurance coverage and protect your loved ones from a worst-case scenario — but it doesn’t get you out of underwriting risk classifications.

Risk classification and management are an integral part of the insurance buying process. If you plan on applying for life insurance in the next few years, see if you can get yourself as healthy as possible before you fill out your life insurance application. Not only will you increase your possibility of paying lower monthly premiums, but you — and the people you love — could also benefit from your improved health. Since taking care of the people closest to you is one of the key reasons to take out a life insurance policy, consider it a win-win.

About Nicole Dieker

Nicole Dieker has been a full-time freelance writer since 2012, with a focus on personal finance and habit formation. In addition to Haven Life, her work regularly appears at Lifehacker, Bankrate, CreditCards.com, and Vox. Dieker spent five years as a writer and editor for The Billfold, a personal finance blog where people had honest conversations about money, and is the author of Frugal and the Beast: And Other Financial Fairy Tales.

Read more by Nicole DiekerOur editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus