A lot of us can probably come up with a financial goal or two, if asked. Maybe we’re trying to save more for retirement this year. Maybe we’re looking for ways to cut costs on our next vacation. Maybe we’re making payments on a mortgage or a student loan (or both).

But many people don’t consider all of the potential financial goals that might come up during a typical lifetime — and because of that, they miss out on opportunities that could save them a lot of money in the long run.

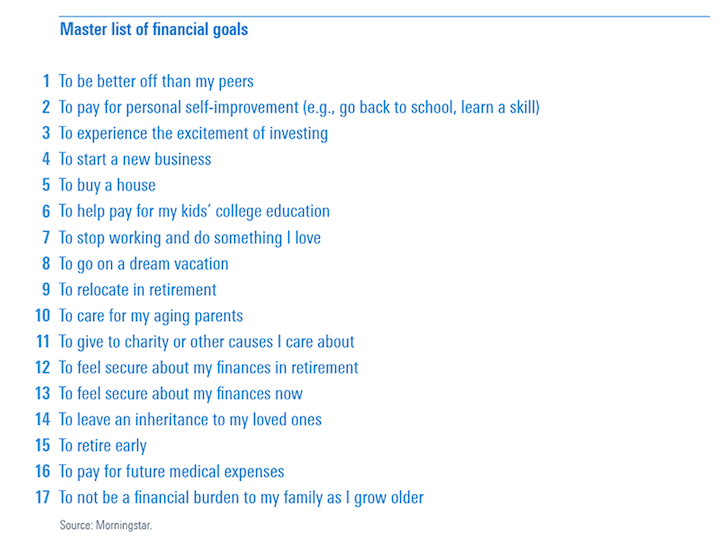

In late 2018, the global financial services firm Morningstar® created a master list of financial goals. They developed this list because they understood that most people, when asked about their financial goals, will respond with whatever’s most important to them at the time. (Next year’s vacation, for example.)

However, after reviewing the master list of financial goals, people begin considering financial goals they hadn’t previously thought of — and when they start working towards those goals, they can start making improvements in their financial lives.

Why Morningstar created its master list of financial goals

“The goal of the master list is to help people think more deeply about their financial goals, therefore allowing them to remember goals that truly matter to them,” Samantha Lamas, behavioral scientist at Morningstar and co-author of the report Mining for Goals: How Behavioral Nudges Can Help Investors Discover More-Meaningful Goals, told me.

In other words: the master list is there to help you remember the financial priorities you may have forgotten. Things like saving for future medical expenses or leaving an inheritance for your children. It’s also there to remind you of financial options you might not have considered, like relocating in retirement or even retiring early.

Lamas explained that Morningstar worked hard to make the master list “comprehensive, but not overwhelming.”

“That involved getting the list down to the right number — which we set at between 10-20 goals — and making sure the list incorporated short-term to long-term goals, and goals that were either more objective or emotion-based.”

Used with permission.

Use the master list to identify your top 3 financial goals

The Morningstar team didn’t just create a master list of financial goals. They also developed a process through which people could use the master list to identify their most important financial goals.

“The goal of the master list is to help people think more deeply about their financial goals, therefore allowing them to remember goals that truly matter to them,” Lamas explained.

When Morningstar works with participants to help them develop their financial goals, they first ask individuals to identify their top three financial goals “off the top of their heads,” as Lamas put it. Then, Morningstar shows those individuals the master list and asks them to identify which of the listed goals are the most important. This helps participants consider financial goals they may have overlooked, such as caring for aging parents or increasing the amount they give to charity.

“Lastly, we ask the individual to consider both their initial top three goals and the goals they identified from the master list,” Lamas told me. “We then ask them to write down what their top three financial goals are, taking all these goals into consideration.”

You can do this exercise yourself, right now. Start by writing down your top three financial goals. Don’t spend too much time thinking about them; just jot down the first three that come to mind. Then, review the master list (above) and ask yourself which three goals on the list are the most important to you. Lastly, compare the three goals you wrote down to the three goals you identified on the master list. How would you rank those six goals? Can you narrow the six goals down to your top three financial goals?

As you do the exercise, you might be tempted to set four or five top financial goals, instead of just three. Be careful, because setting too many goals can make it harder to achieve any individual goal. If you want to buy a house, take a dream vacation, start a new business and put aside money for your kids’ college education simultaneously, it’s going to take a lot longer to save up the cash required for each goal — and you could get frustrated and give up. It might be a better idea to build your new business while you rent, or to buy your house this year and plan your big vacation for next year.

Why life insurance

Life insurance is a financial safety net for your partner, your kids, your life...

Read moreHow financial goals help you make smart money decisions

Once you’ve identified your top three financial goals, it’s time to start putting them into practice. This means making choices now that will help you achieve those goals later — and yes, that can be harder than it looks.

“As human beings, we naturally think in the short-term, which can hurt us when it comes to achieving our long-term goals.” Lamas explained. Her solution? “Create short-term habits that connect to your long-term goals.” If you’re saving for a car, for example, Lamas suggests creating a short-term savings goal. Can you put $50 in your savings account every week? $300 every month? Figure out what makes sense with your budget and then start setting that money aside.

Lamas also suggests setting purchasing rules that help you focus on your long-term goal, such as “always wait a day before buying something over $100.” That way, you’ll be able to put your money where you really want it to go: towards that car, towards your retirement plan or towards your future.

Remember: you can always change your top three financial goals, and you probably will! Different financial goals are more (or less) important at different stages of life, and — as I explained above — you can’t save for everything at once. The master list is intended to help you review some of the most common financial goals, identify which goals are most important to you and help you achieve them.

Plus, once you achieve your most important financial goal, you can start working towards a new one.

Morningstar is a registered trademark of Morningstar, Inc.

Haven Life Insurance Agency offers this as educational only, and the information provided is not written or intended as specific legal advice. Haven Life Insurance Agency does not provide legal advice. Individuals are encouraged to seek advice from their own legal counsel.