Becoming a parent is equally exciting as it is overwhelming. It brings a lot of significant changes, especially when it comes to finances. You want to do everything you can to protect your little one and set them up for a stable future. A lot of parents know a big step they need to take is saving. However, there are other financial moves you should consider as well, that are important to your overall financial health.

Whether you’re expecting your first child, just had one or raising toddlers, we’ve compiled a list of some of the best financial tips for parents. To help, we reached out to financial experts Shannah Compton Game, CFP®, host of Millennial Money Podcast, Ariel Ward, CFP®, at Abacus Wealth, and Mary Beth Storjohann, CFP®, founder of Workable Wealth, to provide insight into some critical money moves parents should consider. Check them out below.

8 financial tips for parents

To help you prepare and navigate your financial life with children, here are eight financial tips every parent should consider.

1. Build an emergency fund

As a parent, it’s important to prepare for the unexpected. Life comes at you fast, and you need to have a plan for when it does. Add kids in the mix and your chances of something unanticipated happening grow. That’s why it’s crucial you have an emergency fund to protect you from unpredictable costs. You are bound to experience your fair share of costly scenarios, and having that cushion of cash stored in your emergency fund will soften the blow.

Aim to save between six to nine months’ worth of essential living expenses. That includes groceries, gas, and any recurring monthly bills. Put this money somewhere you won’t feel tempted to use it.

2. Consider a high-yield savings account or Roth IRA

A high-yield savings account may be a good place for an emergency fund because it has higher interest rates than regular savings accounts and tends to come with no monthly fees. These accounts may require a larger initial deposit than a standard savings account.

Because high-yield savings accounts typically come with significantly higher interest rates, you can earn more on your money and have the ability to reach your financial goals faster.

While designed for your retirement, a Roth IRA also can be used in an emergency. Shannah Compton Game, CFP®, says that “your contributions (which have already been taxed) can be withdrawn at any point in time without a penalty prior to age 59 1/2. So your Roth can be a source of money if you have no other emergency fund.” However, it’s important to note that if you do choose to withdraw from your Roth IRA before retirement, you are taking money away from your retirement.

3. Pay off high-interest debts

You probably want to be debt-free with a solid emergency fund before turning your attention to other financial goals, such as saving for buying a home or investing. That means paying off any high-interest debts you have, such as credit cards and personal loans. Large payments on high-interest debts eat away at your potential to save and invest.

However, you don’t have to pay off all of your debts before you begin saving. Ariel Ward, CFP®, recommends paying off high-interest credit cards first. Once you’ve done that, and if you have a debt repayment plan for lower-interest debt such as auto loans or student loans, it’s probably fine to start investing.

Once you begin investing, you can use the power of compound interest to grow your wealth. The sooner you start saving and investing, the more likely you are to reach your financial goals.

4. Save for your own retirement

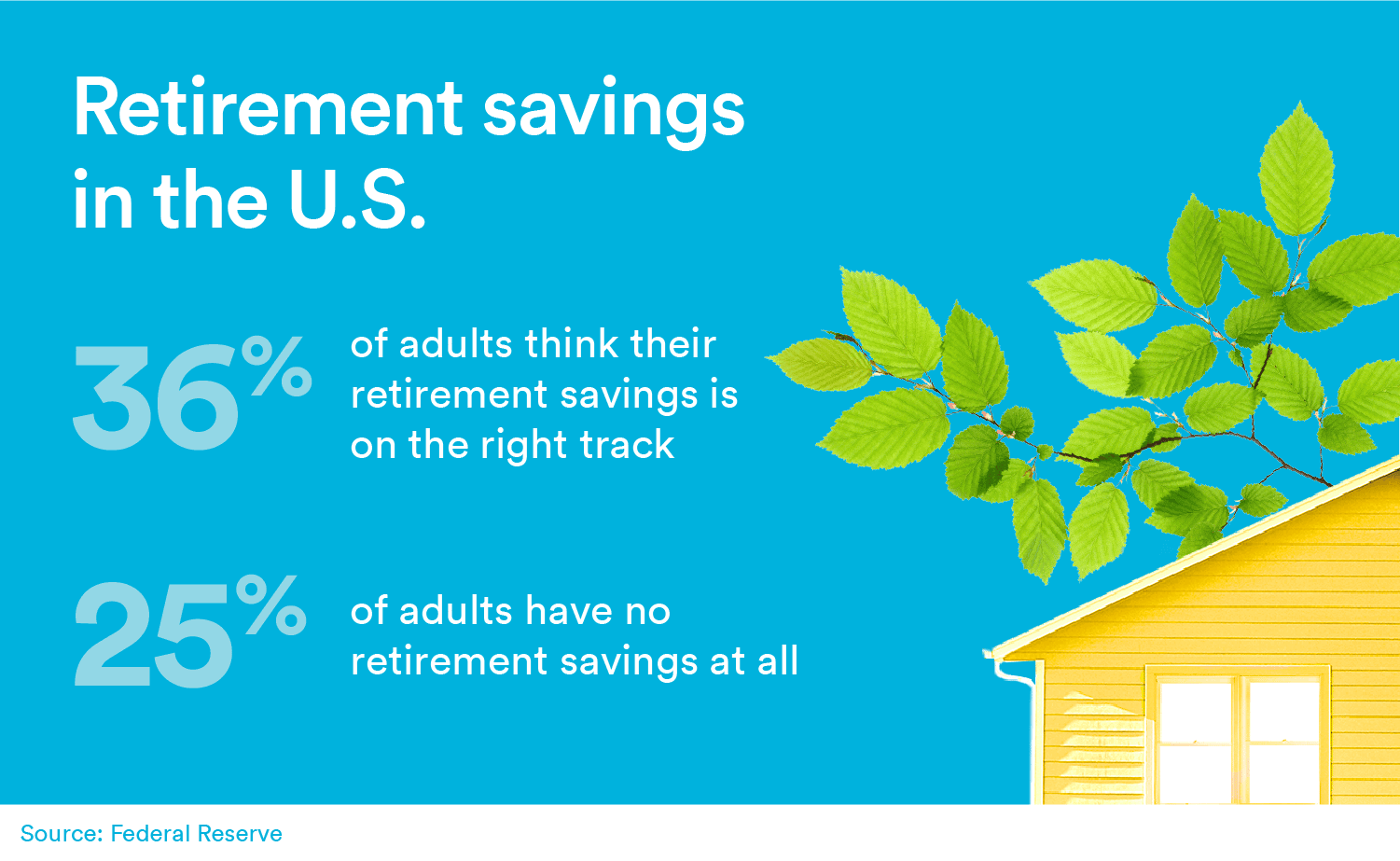

Before you can help your children, it’s important to save enough for your future first. If you don’t have enough money saved for retirement, you may become a financial burden for your adult child. According to the Federal Reserve’s 2018 Report on the Economic Well-Being of U.S. Households, just 36% of U.S. adults think their retirement savings are on the right track and 25% have no retirement savings at all. Simply put, people aren’t saving enough.

“Once you’ve established a healthy emergency fund, maxing out retirement savings is a great way to start investing. You’ll have a tax deduction for most contributions as well as tax-deferred growth on your investments,” says Ariel Ward, CFP®. You can do this through a 401(K) (regular and Roth versions), traditional IRA and a Roth IRA. Ward recommends you consider contributing post-tax to a Roth IRA or Roth 401(K) if you are eligible. Your investments in each of these accounts will grow tax-free if you wait to withdraw the funds after age 59 ½.

So, how much should you save? That’s the million-dollar question, and it will vary from person to person. However, a good rule of thumb is to save around 15% of your pre-tax income each year. If you can’t contribute 15% of your income right now to a workplace retirement plan, at least make sure you’re getting your employer match (usually 3% to 5%). Then, work toward maxing out your 401(k) (contribution limits are $19,000 in 2019 and $19,500 in 2020). One way to reach your retirement plan maximum is to increase your contribution percentage gradually. Many employers will help you automatically boost your contributions with every raise or by every year.

5. Buy life insurance

Life insurance is all about protecting your loved ones. If you know your partner wouldn’t be able to handle expenses if you were to pass away, then it’s time to consider purchasing life insurance. The benefit could help ensure that your partner is able to financially care for your children if something were to happen to you.

Term life insurance is an affordable option. This type of life insurance lasts for a fixed period of time (typically 10, 15, 20 or 30 years) and provides a financial payout to your beneficiaries. That means your beneficiaries would typically be paid a lump sum of tax-free money if you were to pass away. This could help pay for your child’s education and living expenses. Life insurance gives you the peace of mind knowing that your family will be supported financially, even after you are gone. Term life insurance is more affordable when you’re young and healthy. Here are some examples of the cost of coverage:

| 30-year term life insurance rates | Face amount | ||||

| Age | Gender | $250,000 | $500,000 | $750,000 | $1,000,000 |

| 30 | Male | $26.53 | $36.26 | $51.39 | $66.52 |

| Female | $21.52 | $30.23 | $42.34 | $54.46 | |

| 35 | Male | $30.32 | $41.42 | $59.14 | $76.85 |

| Female | $25.14 | $35.40 | $50.09 | $64.79 | |

| 20-year term life insurance rates | Face amount | ||||

| Age | Gender | $250,000 | $500,000 | $750,000 | $1,000,000 |

| 30 | Male | $17.43 | $22.48 | $30.72 | $38.96 |

| Female | $14.99 | $19.46 | $26.19 | $32.92 | |

| 35 | Male | $18.06 | $23.34 | $32.01 | $40.67 |

| Female | $15.37 | $20.32 | $27.49 | $34.65 | |

| 10-year term life insurance rates | Face amount | ||||

| Age | Gender | $250,000 | $500,000 | $750,000 | $1,000,000 |

| 30 | Male | $11.94 | $14.72 | $19.09 | $23.45 |

| Female | $10.93 | $13.00 | $16.51 | $20.01 | |

| 35 | Male | $12.55 | $15.59 | $20.38 | $25.17 |

| Female | $11.04 | $13.43 | $17.15 | $20.87 | |

| Source: Haven Life |

6. Invest in your child’s education

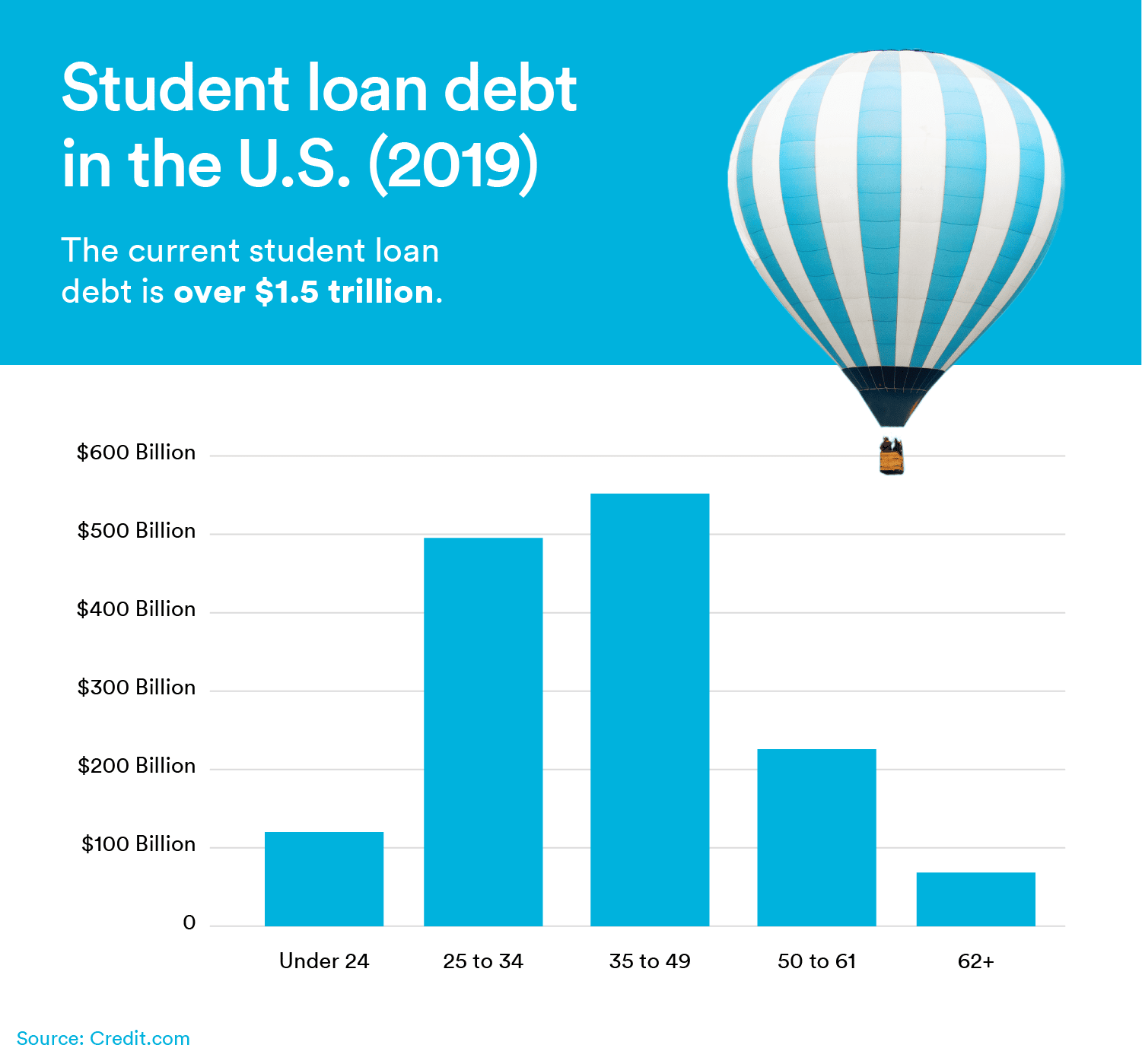

This year, the current student loan debt has grown to around $1.52 trillion. It’s now the second-largest type of debt in the country. Meanwhile, the price of tuition steadily rises. So it’s imperative you start saving for your child’s education once you have the means. Consider a 529 college savings plan.

This type of fund grows tax-free and can be withdrawn tax-free if used for your child’s qualified education expenses, such as college tuition, fees, room and board, and school equipment. You can also withdraw up to $10,000 per year to pay for private primary and secondary education tuition. How much you can save in your 529 account depends on the state sponsoring your plan, but maximums range from around $200,000 to around $550,000.

A Coverdell Education Savings Account (ESA) is another option. For each child, you are allowed to contribute up to $2,000 per year, per beneficiary. These contributions are made post-tax and can grow tax-deferred. Like a 529 plan, these plans can be withdrawn tax-free for qualified education expenses, including the costs of elementary and secondary school as well as public and private college.

However, if either a 529 plan or a Coverdell ESA is used for non-qualified education expenses, there will be a 10% penalty on the earnings, and these earnings will be reported as taxable income.

Pro Tip: When your child is young, have family members and friends contribute to your 529 plan or Coverdell ESA instead of giving other gifts to your child.

7. Use the Child Care Tax Credit or Dependent Care FSA

You have two common options when it comes to savings on child care — the Child Care Tax Credit or a Dependent Care FSA.

The Child Care Tax Credit is typically worth between 20% to 35% of qualifying child care costs. This percentage directly correlates with your income. As of 2019, the total expenses you can claim is $3,000 for one child and $6,000 for two or more children.

A Dependent Care FSA is an employer-sponsored, pre-tax account. You set up automatic deductions from your paychecks that are contributed to this account and are eligible to use those funds for qualifying child care expenses. The current maximum contribution to the account is $5,000 per year for each household.

“If you’re in a situation where you need to pick between the Dependent Care FSA or the Child Care Tax Credit, you should start by calculating your total child care expenses each year, and the benefits you’d receive using each program,” explains Mary Beth Storjohann, CFP®.

8. Take advantage of your employee benefits

Your employer offers you health benefits for a reason — take advantage of them. Set some time aside to fully understand your health benefits. One of the smartest money moves you can make is to ensure that your health insurance plan matches up with your health care needs, says Shannah Compton Game, CFP®. For example, if you plan on getting pregnant, make sure you choose a plan with rich maternity benefits.

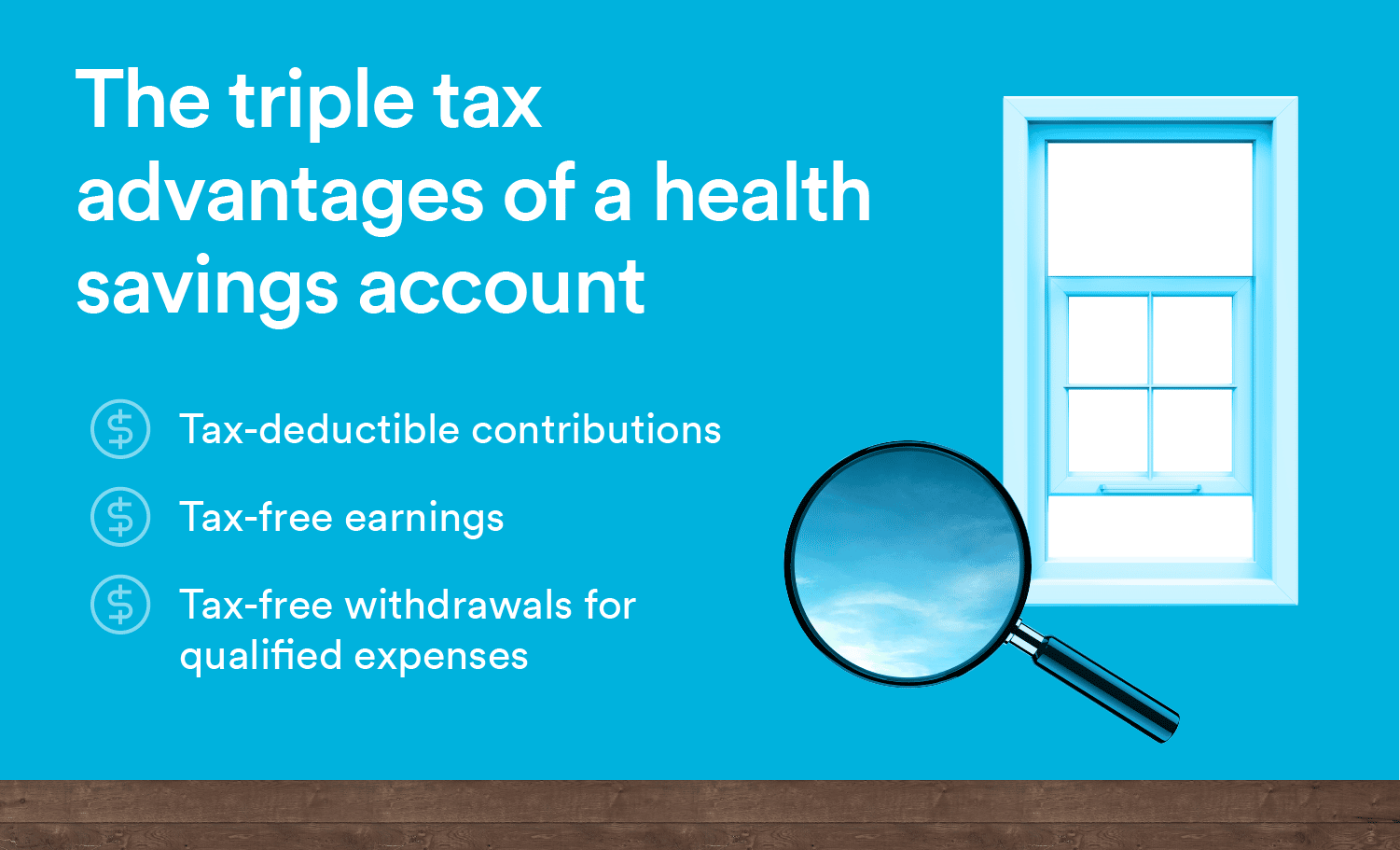

Health Savings Accounts (HSA) also can help you save money on medical costs. These accounts, which are only available in conjunction with high-deductible health plans, offer pre-tax or tax-deductible contributions, tax-free withdrawals, and tax-free earnings. Families are allowed to contribute up to $7,000 in 2019 and $7,100 in 2020 with the option to roll funds over year after year. You can use an HSA to bank your savings for medical expenses on a tax-favored basis. You also have the option to keep unused savings in your HSA to pay for medical expenses in retirement.

Another valuable option is a Health Care Flexible Spending Account (FSA). Funds in a Health Care FSA are pre-tax and can also be used for out-of-pocket health care costs. In 2019, you can contribute up to $2,700 in a Health Care FSA, but that money usually doesn’t roll over to the next year. So if you don’t use it, you lose it. That said, some employers may allow you to roll over up to $500. Check with your HR department.

No matter how you plan on saving and investing for your child, don’t feel like you have to do it all at once. Start small and only save and invest what you can afford it. And while it’s natural to want to give your children everything, consider taking care of your own retirement first. Once you’ve paid off all high-interest debts, have a healthy emergency fund and have started to save for your own retirement, you’ll be in a better position to begin saving and investing for your children.

Haven Life Insurance Agency does not provide tax, legal, or investment advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or investment advice. You should consult your own tax, legal, and investment advisors before engaging in any transaction.