From politics to leadership to household roles, discussions about gender in 2019 continue to permeate all aspects of culture. As a life insurance startup, we understand how gender can play a role in one’s physical well-being. After all, it’s well-recorded that women have a longer life expectancy than men. But as societal norms evolve, it’s also important to understand how gender may also affect a family’s financial well-being.

Though aspects of life insurance may seem complicated, it’s most easily defined as a payment given to your beneficiary in the event of your death. Individuals usually start thinking about life insurance during the life events that take them from “me” to “we” — entering a lifelong partnership, buying a home or having children. These events trigger many emotions, and one understandable reaction is wanting to provide for your family if you were to die.

Life insurance forces people to decide: What financial value do I place on my life?

The Gender, Roles and Life Insurance survey, conducted by online life insurance agency Haven Life, interviewed parents with children under the age of 18. We sought to understand how women and men perceive their value when looking at the context of life insurance and the key roles they take on to care for their families.

Understanding how parents view the impact of their death

We asked respondents a few questions to understand the differences between how men and women view their own roles in the household and how those perceptions inform the financial value they place on their lives.

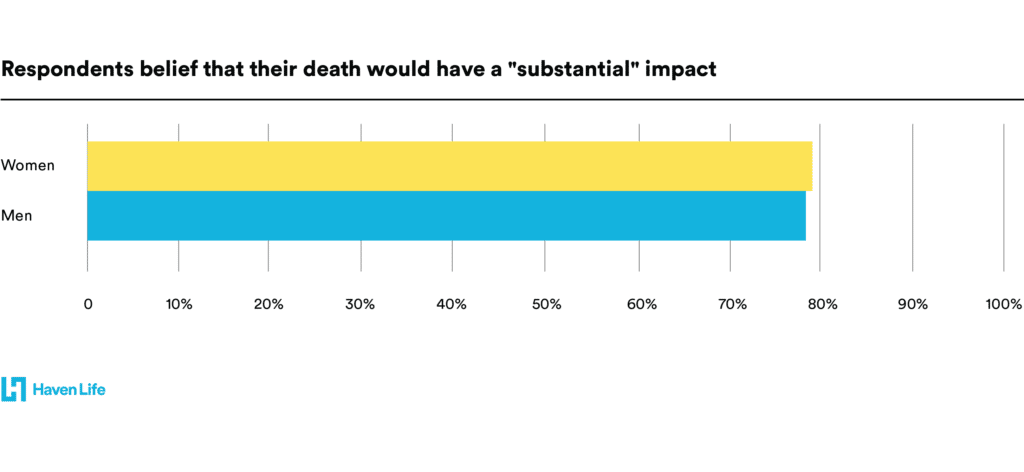

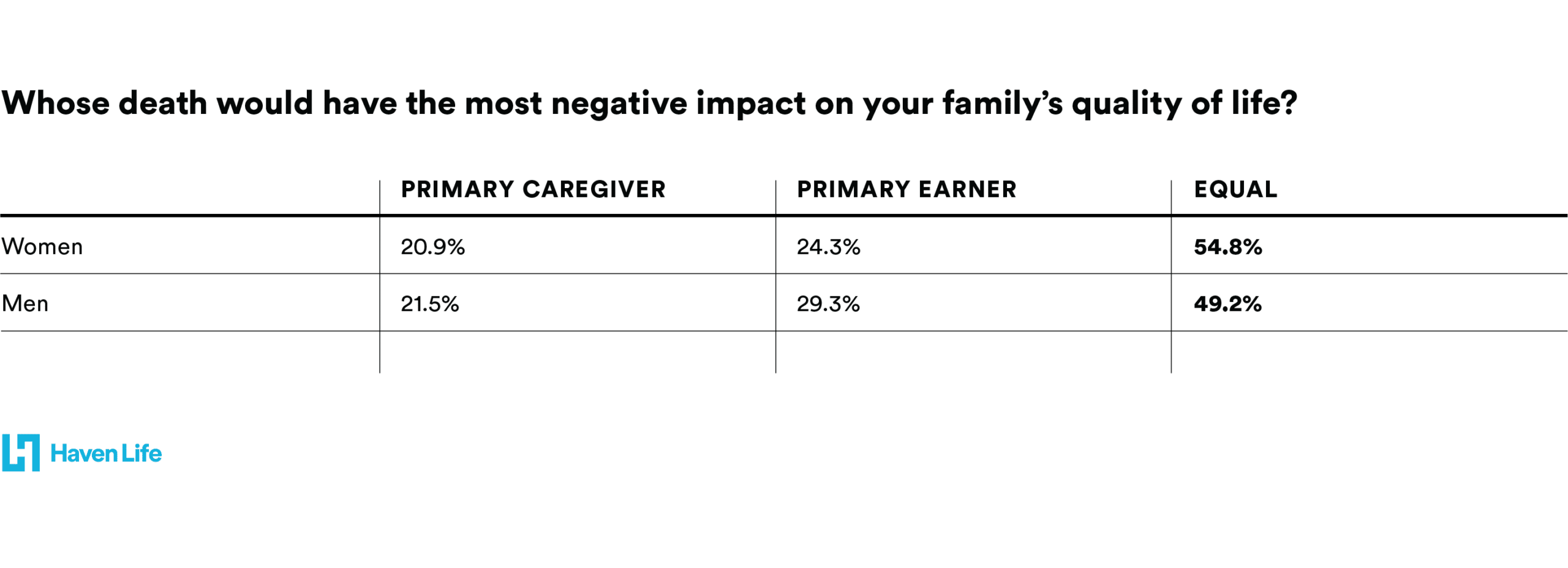

The majority of women (79%) and men (78%) said their own death would have a “substantial” impact on their family’s quality of life. Similarly, both men and women were more likely to believe that the death of either parent — regardless of their status as a primary earner or caregiver — would have an equally negative effect on their family’s quality of life.

Identifying a life insurance gender gap

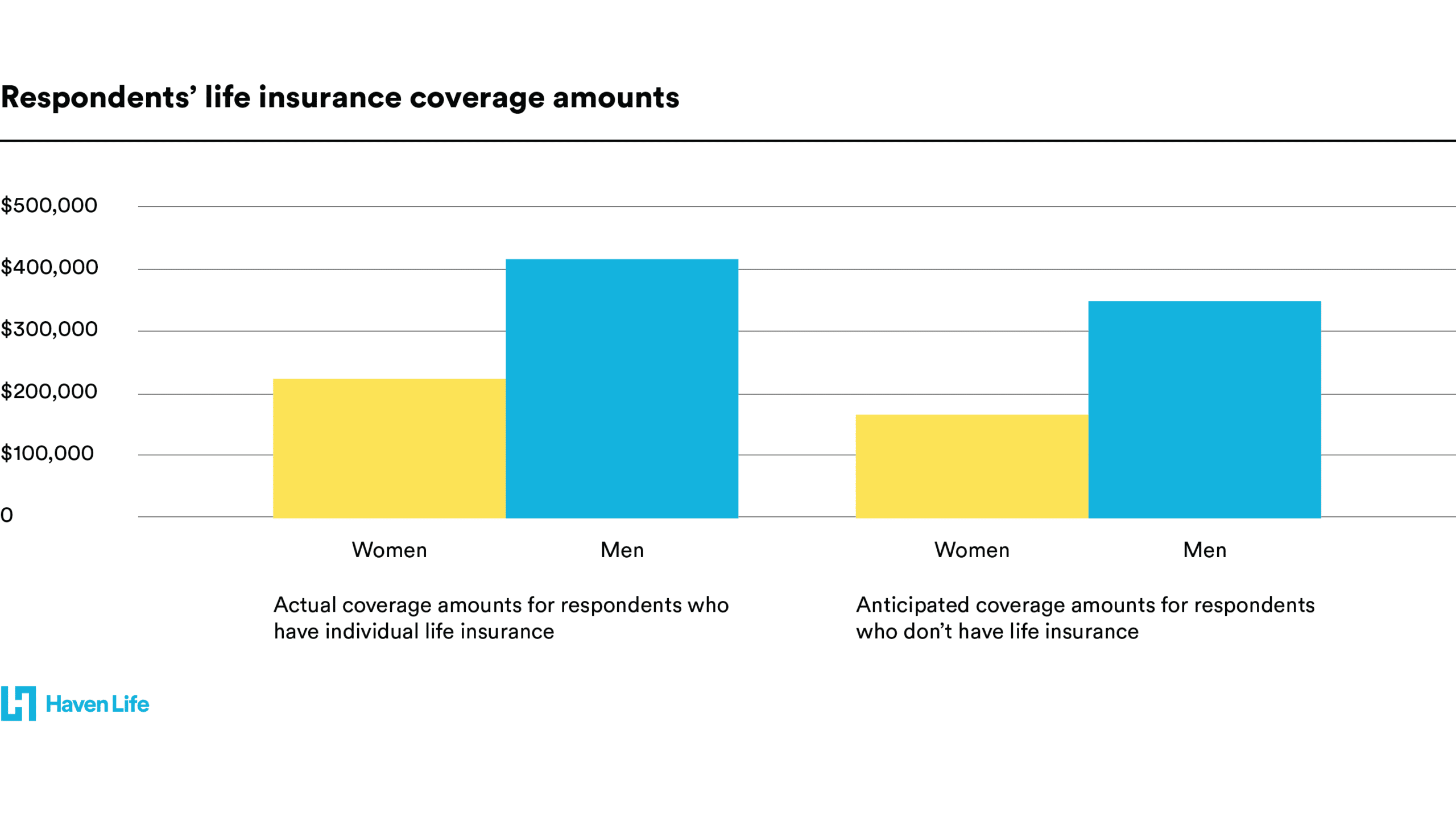

We wanted to understand the differences between how women and men value their lives, measured by life insurance coverage. Despite respondents indicating that the death of either partner would have a substantially negative impact on the family, women were less likely to have coverage and also put a lower financial value on their lives when compared to men.

Men with life insurance valued their lives financially nearly 2 times more than women.

Sixty-seven percent of women surveyed said they had life insurance, compared to 79% of men. Of those who had an individual life insurance policy, the women had an average coverage amount of $231,342, compared to men who had an average amount of $423,102.

Men with life insurance valued their lives financially nearly 2 times more than women.

When respondents who did not have coverage were asked how much life insurance they would buy, the gap still persisted. Women respondents without life insurance indicated they’d buy an average coverage amount of $175,423. The average amount listed by men was $355,348.

Gender roles at home and perceptions of their impact on the family

The Gender, Roles and Life Insurance survey found women and men equally said that their own deaths would have a substantial impact on their families, despite a clear disparity in income levels and household responsibilities.

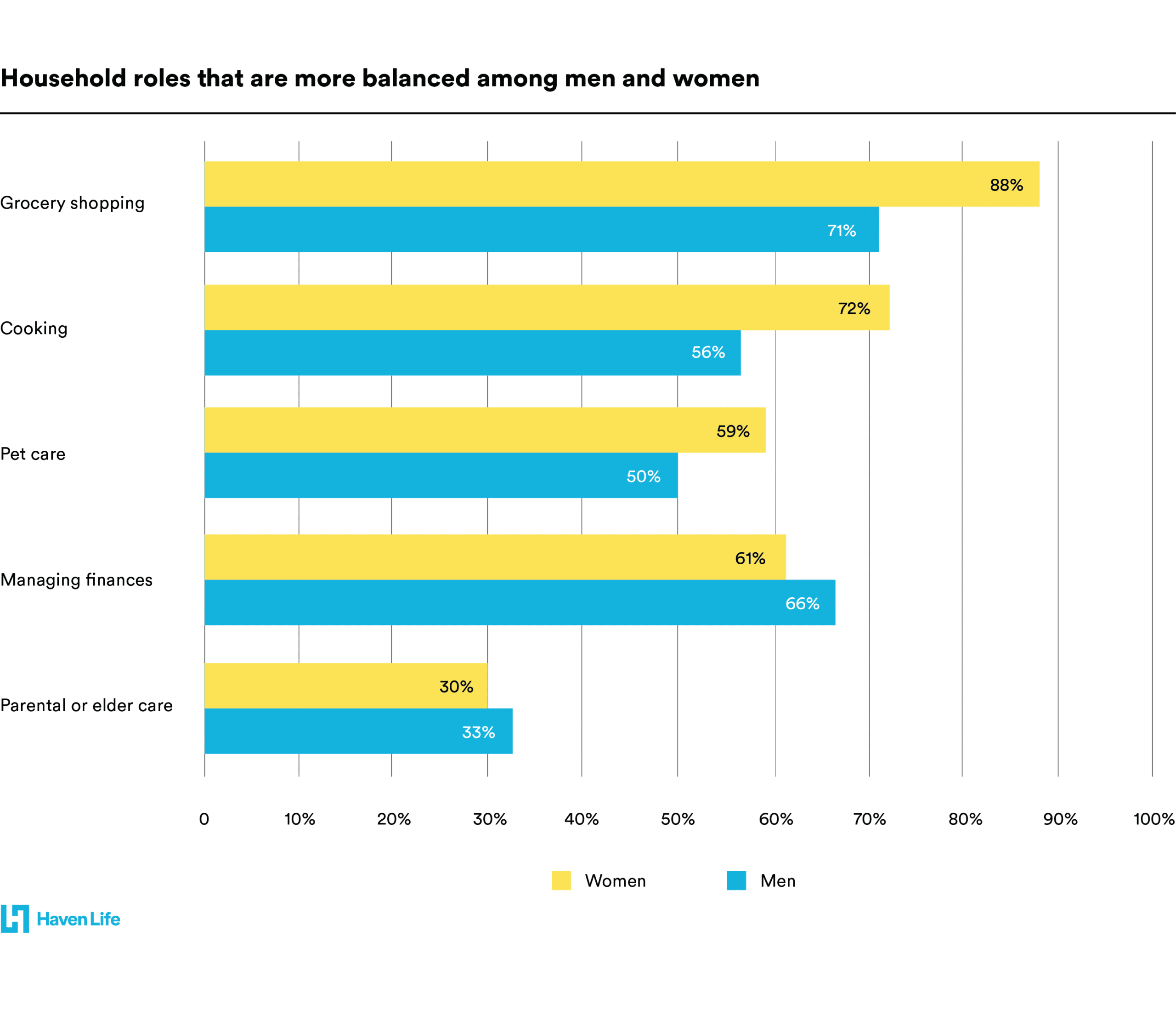

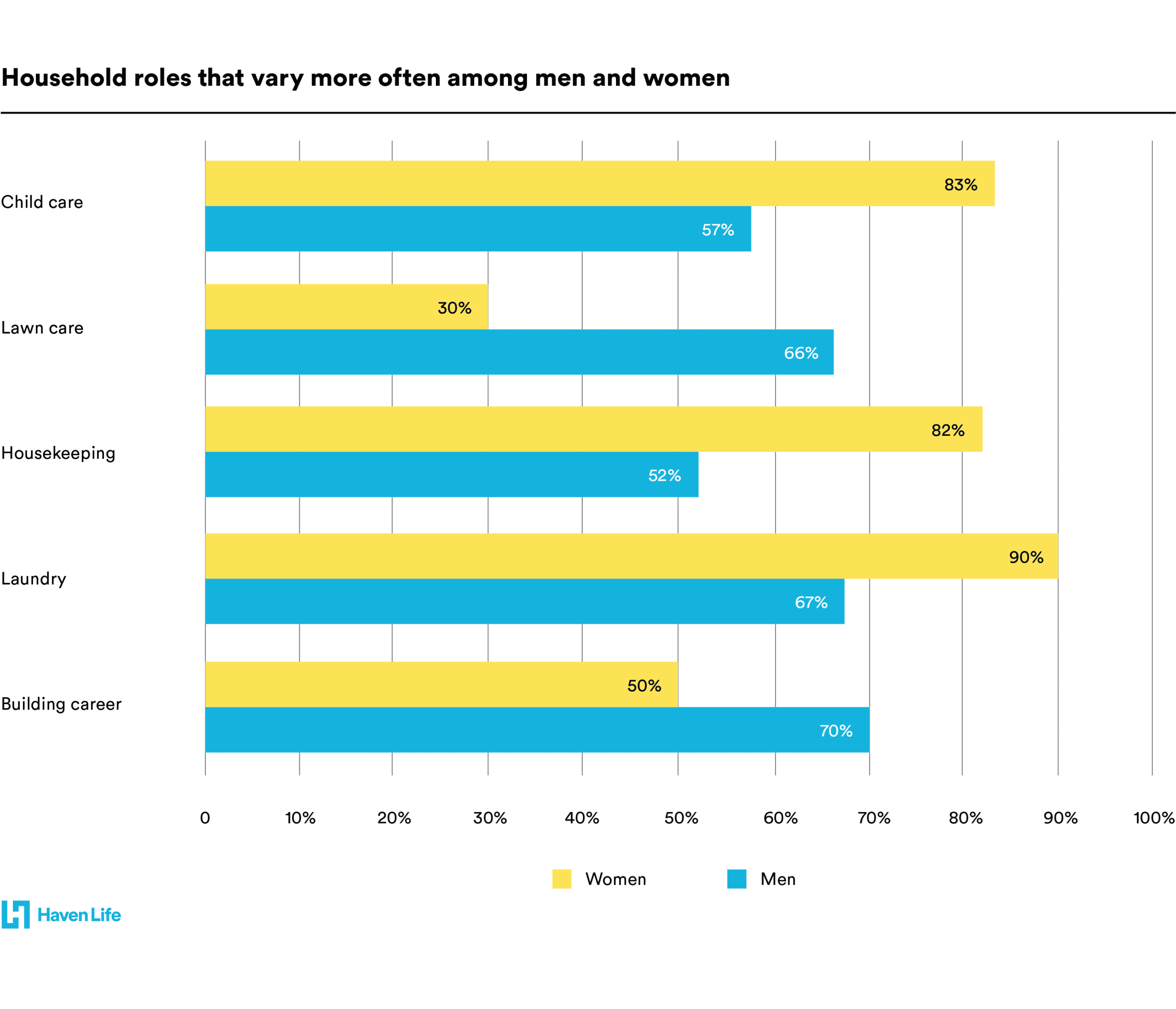

Respondents were asked to select all roles they take on in their households and their lives, with women taking on an average of 6.44 roles compared to men who claim 5.88. In particular, the survey found that 83% of women respondents indicated they take on the role of child care versus 57% of men respondents claiming this role.

Other roles were more evenly distributed.

However, there were larger discrepancies with a few roles:

Income differences by gender

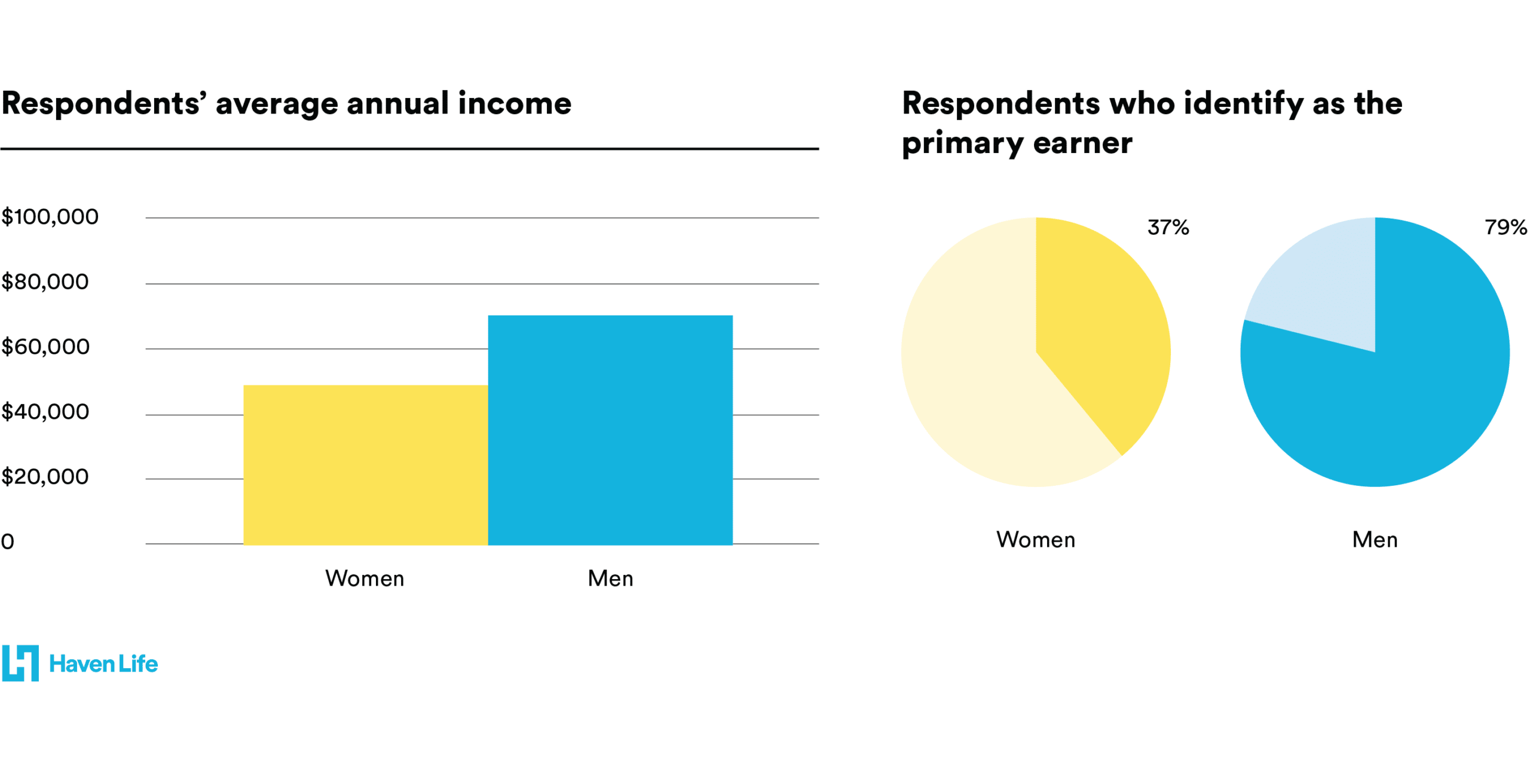

When evaluating gender disparities among the survey answers, we found that men are far more likely to identify as the primary earner (79%) compared to women (37%). The average income for all women respondents was $52,484 compared to the average income for men respondents at $72,482.

The pay difference is noteworthy because of the cultural context around the gender pay gap. In 2018, women earned 85% of what men earned, according to a Pew Research Center analysis of median hourly earnings of both full- and part-time workers in the United States.

[Editor’s note: We did not ask respondents if they were currently employed or about their occupation. We asked what their individual income is.]

We must rethink how we value care

Conventional wisdom has always stated that an easy way to ballpark the amount of life insurance you need is somewhere between five to 10 times your annual salary. But in taking a closer look at some of the gender disparities unveiled through this survey, this life insurance rule of thumb doesn’t always stack up.

For example, the 5X to 10X multiplier for determining life insurance coverage needs is problematic if there is an income gap.

If women are systematically earning less compared to men, the life insurance rule of thumb only aids in further undervaluing the contribution of women, which can put a family’s financial security at risk.

Furthermore, the conventional approach doesn’t factor in the cost savings generated by a stay-at-home parent. These caregivers may not technically earn a salary, but certainly there is real value in rearing children. In fact, Salary.com recently calculated all the work a stay-at-home mom or dad accomplishes and equated it to an annual income of about $178,201 if a family had to outsource it all.

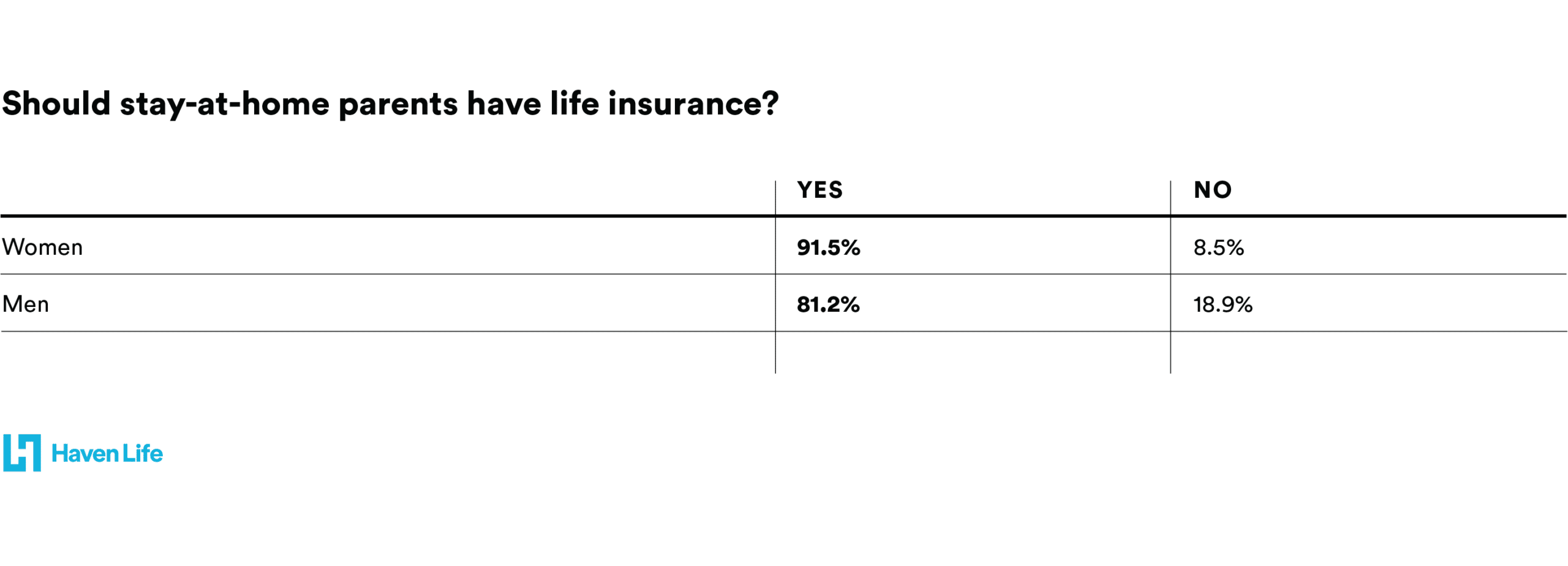

Indeed, one question that gained almost universal consensus from survey respondents was whether a stay-at-home parent should have life insurance. Both women and men overwhelmingly responded “yes.”

Overall, the survey results show that there is a life insurance gender gap. Despite the belief that the death of either partner would have a substantial impact on a family’s quality of life, households have less financial protection for the loss of a mom compared to a dad.

As a society, and especially as the gender pay gap persists, we must rethink how we value care from both a cultural and monetary perspective in order to recognize the substantial impact all parents have on their families.

Methodology

Haven Life conducted a quantitative survey between August 13 – August 15, 2019 and collected N=385 completes. Respondents were required to be between 18-55 years old and to have children under the age of 18. An equal number of men and women were surveyed (Women=190, Men=195). The median respondent’s age was 35 years old. The median HHI was $57,094*.

*Median HHI in the US in 2017 was $61,372. Source

Haven Life Insurance Agency, LLC (Haven Life) conducted this research for educational/informational purposes only. Haven Life is an online life insurance agency offering term life insurance issued by Massachusetts Mutual Life Insurance Company.