How Trust & Will makes creating a legal will less hard

Trust & Will offers an online solution for creating a legal will that’s streamlined, intuitive and quite pleasant.

Trust & Will is a partner of Haven Life Plus — a suite of services that helps policyholders live healthier, fuller and more protected lives. Haven Life Plus is an innovative rider included in the Haven Term policy that gives customers access to free or discounted benefits including an online will service, a digital safe deposit box, an at-home DNA test and health report, and family health clinic services. Learn more about Haven Life Plus here.

More than 150 million Americans know they need a Will but haven’t gotten around to it yet due to a concern of it being a confusing, time-consuming process. (Sound familiar?)

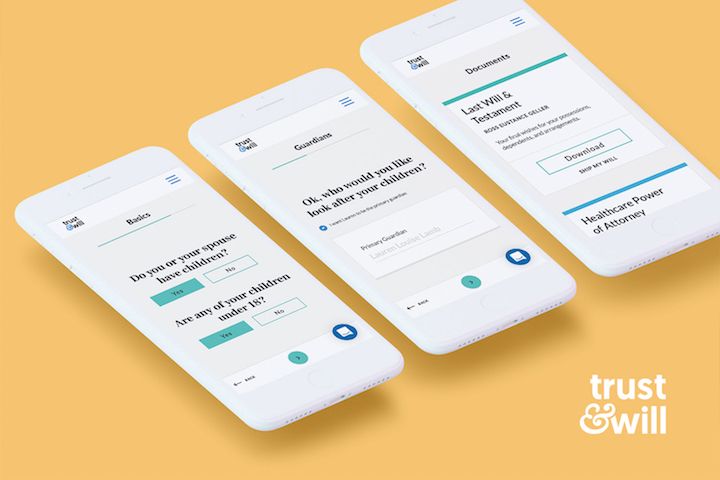

Enter: Trust & Will. They’re a technology company that offers an online solution for creating a legal will that’s streamlined, intuitive and quite pleasant. Now there are a few words you never thought you’d see in a sentence together.

The innovative experience is full of helpful prompts and jargon-busting tips so you can move through questions quickly and confidently. No prior legal documents or experience is needed to complete the process and it can be completed within minutes, not months.

In this article:

Trust & Will history

Cody Barbo, Daniel Goldstein, and Brian Lamb founded Trust & Will to modernize the estate planning experience so more individuals and couples will protect their physical assets, digital assets, and health directives.

“We started Trust & Will with a mission to help our friends and family protect their legacy. We’ve designed an experience with the everyday person in mind, taking a traditionally expensive and daunting process, and making it simple and secure.”

Trust & Will cost

Trust & Will offers an affordable price point for creating an online will.

An individual will is $159 and a couples’ will is $259. The couples version includes two comprehensive legal wills. An individual trust is $599 and a couples’ trust is $699. Haven Term policyholders can simply log in to your account center and retrieve your individual promo code to make an individual or couples’ will or trust at no cost. If you need assistance locating your promo code, feel free to reach out to customer support.

How Trust & Will works

The experience of creating a will is simple and intuitive with Trust & Will’s user experience. It guides you through the important designations with opportunities for elaboration available. On average, it takes 15 minutes for an individual and 20 minutes for a couples’ will, according to the company website, and can be accomplished online.

The process of creating a will covers topics including:

- Naming a beneficiary

- Listing and allocating assets

- Designating guardians for children or pets

- Burial and funeral preferences

- Optional: healthcare power of attorney

- Optional: living will

The fine print: Once a will is created, it must be notarized offline. Additionally, Trust & Will is not currently available to residents of Washington, Missouri, or North Carolina, and the Haven Life Plus rider is not available in Florida, New York, North Dakota, South Dakota and Washington.

Who Trust & Will is right for?

If you think the need for a will is limited to parents, tech barons and pro athletes, think again. All of us have stuff, and most of us would like to leave it to someone we love hassle-free. This is where a will becomes a valuable way to put your legacy in writing.

If you’re in one of the following categories, having a will is essential:

- You own property. If you own a house, a car, or even furniture or devices that have value, like your smartphone, laptop, and TV, then having a will ensures that these assets will be divided the way you wish.

- You’re married. You may assume that all your things will automatically go to your spouse, and while that’s the law in many states, having a will ensures this happens promptly, without complications. For example, if you die without a will and a check arrives in your name only, your spouse would have to get a court-appointed administrator to have it cashed.

- You have children. While experts agree it’s essential for all adults to create a will, if you have minor children, you definitely need a will so you can name a legal guardian and a guardian of the estate — someone who is able to manage money for them until they reach legal age.

- You have a pet. For many of us, our pet is a loving member of our family who also needs a backup plan if something happens to us.

Helpful tips for using Trust & Will

Thanks to modern technology, creating a will is a simple administrative task that you can check off your to-do list — on your own time — in about 20 minutes. That said, there are some items and conversations you can have prior to creating a will to make the process even more seamless and, arguably, the peace of mind will be a bit sweeter.

Talk to potential guardians

The most sensitive conversation is probably the one to have first. Sure, technically you could do this after the fact, but the legally responsible thing to do is talk to guardians before you appoint them. Talking to your loved ones about death can be uncomfortable, but it’s important to have these discussions — especially when children are involved. Whether it’s your parents, a sibling or a close friend, you’ll need to discuss your wishes to list them as a guardian for your child if anything were to happen to you and your partner. Additionally, this is the right time to talk about financial preparedness for the unexpected (i.e. life insurance, college savings plans, and savings accounts) and both you and the guardian’s perception of financially preparing for dependents.

Note: a similar conversation should be had with potential guardians of a pet.

Take a quick inventory of your important items

It may not be necessary to list every single item you own, but if you have some family heirlooms or those with sentimental value – list them. For example, who would you leave the ring grandma gave you to? Or, what about those travel souvenirs your late grandfather gave you? Now is the time to list them.

Think about how you’d like to distribute your assets and plan to list them

First, it’s advisable before getting started with your will to be prepared to fully and accurately list your financial assets, where they are located and an estimated value.

Next, you’ll need to identify who you’d like to leave those assets to. For those who are married or have children, this is usually a breeze — 100% of assets to [insert partner’s name].

Don’t forget your digital accounts

A digital executor specifically looks after your digital accounts like social media, email web domains, and even cryptocurrency. Do you want your partner to handle this? A parent? Or a best friend? Be prepared to list them… and maybe give them the account logins to make their life a little easier.

Consider your final arrangements

Do you want to be cremated? Would you prefer a formal funeral service? Should California Dreamin’ be played at your service? Whatever your preferences are, here’s your opportunity to list them.

Creating a will is an important step in protecting your loved ones, your assets, and your legacy. And, fortunately, doing so does not need to be complex. Trust & Will offers a user-friendly way to create a legal will so that you’ll have the peace of mind in knowing your wishes will be carried out as planned.

About Brittney Burgett

Brittney Burgett is the marketing and communications director at Haven Life, a customer-centric life insurance agency backed and wholly owned by MassMutual. She joined the startup more than five years ago as one of the first ten employees and oversees external communications, content, SEO and various other growth marketing initiatives. Brittney is a passionate leader who believes that managing your financial life doesn't need to be intimidating or complicated and brings that philosophy to all the editorial and brand work at Haven Life. Prior to her role at Haven Life, Brittney worked in public relations, her client list included brands in the tech, food and nutrition spaces.

Read more by Brittney BurgettOur editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus