Why life insurance is the ultimate Valentine’s Day gift

Forget chocolates, flowers and a nice dinner. The best gift for Valentine’s Day is life insurance. Here’s why it is the ultimate act of love.

What are the components of a great Valentine’s Day gift? It should be romantic, personal, intimate even. It should demonstrate both love and commitment, not to mention that elusive blend of spontaneous passion and careful planning. It should be a surprise, if possible, yet somehow perfect, as if your beloved had specifically asked for it in advance.

Welp, we’ve looked high and low, and there’s only one gift that checks all these boxes: Yep, it’s life insurance.

Hear us out, because we’re experts in this sort of thing. A life insurance policy says you care, and it says you’re serious about your relationship. It shows that you can think long-term, and that you’re creative—after all, life insurance isn’t the kind of thing that pops up on those clickbait listicles about Valentine’s Day gift ideas.

Just imagine how surprised he or she will be when opening the box. (Which reminds us: You should print the policy and wrap it in a box.)

Your special someone will appreciate it for years and years to come. Can you say that for flowers or chocolate? We think not. Best of all, and unlike some gifts we can think of, it will definitely fit.

But in case you’re still skeptical, please indulge us in more detail as to why life insurance is the ultimate Valentine’s Day gift.

In this article:

1. Life insurance is romantic.

Sure, you could stand outside someone’s door with a boombox and declare your love through a perfectly chosen pop song, Say Anything-style. But we’ve found that grand gestures, while impressive, often ring hollow.

It’s the small kindnesses that show you care. Holding open a door. Remembering an anniversary. Hiding a love note in someone’s bag before they head to work.

Life insurance is a little like that. It’s not a small kindness, exactly, but it’s not an over-the-top gesture, either. Instead, it’s a solid way of saying “We’re in this together, so let’s take care of each other for the long haul.”

It demonstrates that you want to be Mr. or Ms. Right, not just Mr. or Ms. Right Now. And really, what’s more romantic than that?

2. Life insurance will last.

Other Valentine’s Day gifts never do. Flowers wilt. Chocolates get eaten (or left, all sad-like, in the box until someone throws them out). Meanwhile, you could take out a term life insurance policy for 20 or 30 years.

In fact, life insurance coverage is that rare gift that almost everybody needs — no matter your age, your marital status, if you get life insurance through work, or whether you have (or don’t have) kids.

And if and when your loved ones receive the death benefit, they can use it toward final expenses like burial and a funeral. (Nothing says long-lasting gift like the word “final.”)

All types of life insurance are designed to financially protect your loved ones. That means they can pay off any outstanding loans, mortgage debts, or other expenses, so long as you keep up with your premium payments.

3. Life insurance will really wow someone

Diamonds are forever, but there’s a difference between the rocks used for industrial drills and the ones on engagement rings. Same goes for life insurance.

A life insurance policy — whether it’s a 20-year policy, a 30-year policy, or even a million-dollar policy — is only as good as the company that backs it.

When looking at life insurance companies, you want a policy issued by a respected insurance company that is well-rated by leading independent rating agencies (like A.M. Best) so that you’re taking an important step in protecting those you love. (We know, again with the “l” word — but we’re lovers, you knew that already.)

Haven Life is an insurance agency, but each policy is backed by either MassMutual, or its subsidiary C.M. Life, meaning each policy is backed by some of the top-rated companies around.

4. No waiting for delivery

Do you have access to a printer? That’s all you need to turn your policy into something tactile to wrap in time for Feb. 14. You could take out the policy that very morning!

No printer? Well, you can always forward the email confirmation.

5. Did we mention life insurance is guaranteed to fit?

Because it will. Just for you..

6. If you play your cards right, a life insurance policy might even lead to beneficiaries.

Look, if someone gave us a life insurance policy for Valentine’s (hint, hint), let’s just say we would be very generous with rewarding that certain someone, if you know what we mean. (We mean we might get them a life insurance policy to say thank you.)

But yeah, romance will be in the air, and one thing could lead to another, and … well, the next thing you know, you’ll be wondering how to name a child as a beneficiary for your policy.

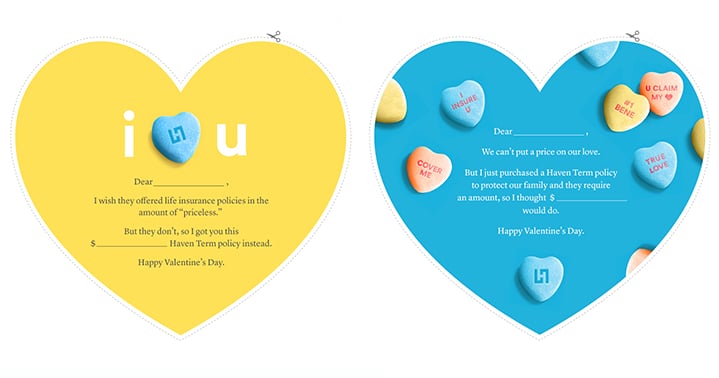

And we know, we know — you’re thinking it’s not the kind of present that makes for a great presentation, a memorable “wow moment” they’ll be talking about for years to come. Well, you’d be wrong — just check out these printer-ready Valentine’s Day Coverage-grams we made. Consider it our Valentine’s Day gift to you.

About Louis Wilson

Louis Wilson is a freelance writer whose work has appeared in a wide array of publications, both online and in print. He often writes about travel, sports, popular culture, men’s fashion and grooming, and more. He lives in Austin, Texas, where he has developed an unbridled passion for breakfast tacos, with his wife and two children.

Read more by Louis WilsonOur editorial policy

Haven Life is a customer-centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our editorial policy

Haven Life is a customer centric life insurance agency that’s backed and wholly owned by Massachusetts Mutual Life Insurance Company (MassMutual). We believe navigating decisions about life insurance, your personal finances and overall wellness can be refreshingly simple.

Our content is created for educational purposes only. Haven Life does not endorse the companies, products, services or strategies discussed here, but we hope they can make your life a little less hard if they are a fit for your situation.

Haven Life is not authorized to give tax, legal or investment advice. This material is not intended to provide, and should not be relied on for tax, legal, or investment advice. Individuals are encouraged to seed advice from their own tax or legal counsel.

Our disclosures

Haven Term is a Term Life Insurance Policy (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001 and offered exclusively through Haven Life Insurance Agency, LLC. In NY, Haven Term is DTC-NY 1017. In CA, Haven Term is DTC-CA 042017. Haven Term Simplified is a Simplified Issue Term Life Insurance Policy (ICC19PCM-SI 0819 in certain states, including NC) issued by the C.M. Life Insurance Company, Enfield, CT 06082. Policy and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in California is OK71922 and in Arkansas 100139527.

MassMutual is rated by A.M. Best Company as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and is subject to change. MassMutual has received different ratings from other rating agencies.

Haven Life Plus (Plus) is the marketing name for the Plus rider, which is included as part of the Haven Term policy and offers access to additional services and benefits at no cost or at a discount. The rider is not available in every state and is subject to change at any time. Neither Haven Life nor MassMutual are responsible for the provision of the benefits and services made accessible under the Plus Rider, which are provided by third party vendors (partners). For more information about Haven Life Plus, please visit: https://havenlife.com/plus